I recently received an email from an individual that contained the following bit of portfolio advice from a major financial institution:

“Despite the tumble to begin this year, investors should not panic. Over the long-term course of the markets, investors who have remained patient have been rewarded. Since 1900, the average return to investors has been almost 10% annually…our advice is to remain invested, avoid making drastic movements in your portfolio, and ignore the volatility.”

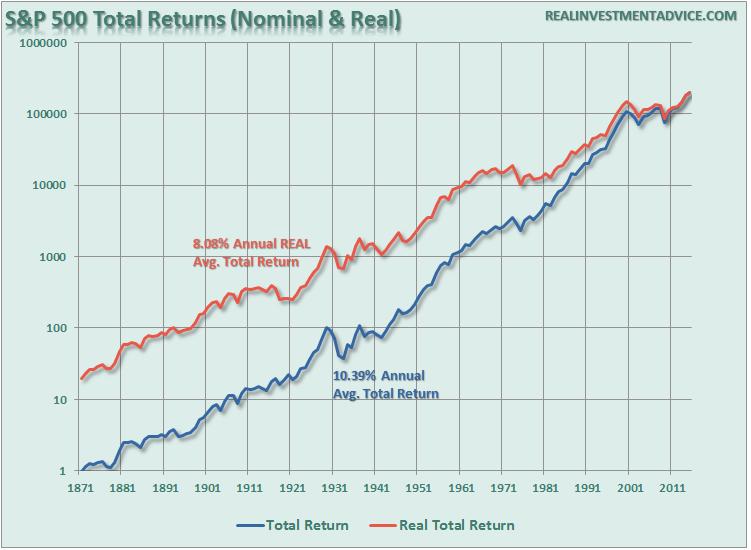

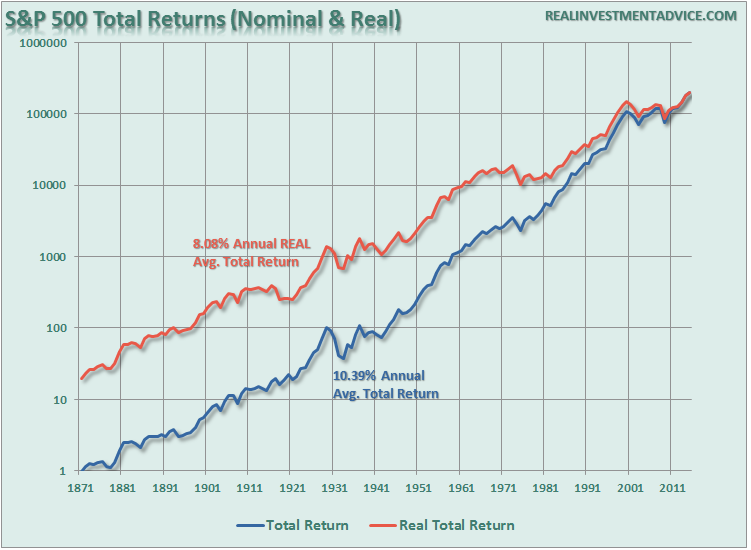

First of all, as shown in the chart below, the advice given is not entirely wrong – since 1900, the markets have indeed averaged roughly 10% annually (including dividends). However, that figure falls to 8.08% when adjusting for inflation.

It’s pretty obvious, by looking at the chart above, that you should just invest heavily in the market and “fughetta’ bout’ it.”

If it was only that simple.

There are TWO MAJOR problems with the advice given above.

First, while over the long-term the average rate of return may have been 10%, the markets did not deliver 10% every single year. As I discussed just recently, a loss in any given year destroys the “compounding effect:”

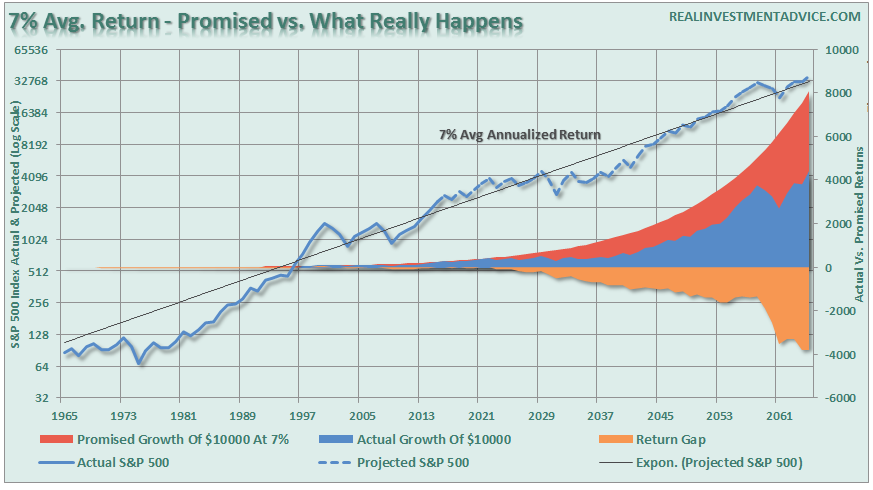

Here is another way to view the difference between what was “promised,” versus what “actually” happened. The chart below takes the average rate of return, and price volatility, of the markets from the 1960’s to present and extrapolates those returns into the future.

When imputing volatility into returns, the differential between what investors were promised (and this is a huge flaw in financial planning) and what actually happened to their money is substantial over the long-term.

The second point, and probably most important, is that YOU DIED long before you realized the long-term average rate of return.

The Problem With Long-Term

Let’s consider the following facts in regards to the average American. The national average wage index for 2014 is 46,481.52 which is lower than the $50,000 needed to maintain a family of four today.

If we assume that the average retired couple will need $40,000 a year in income to live through their “golden years”they will need roughly $1 million dollars generating 4% a year in income. Therefore, 90% of American workers today have a problem.

However, what about those already retired? Given the boom years of the 80’s and 90’s that group of “baby boomers” should be better off, right?Not really.

Leave A Comment