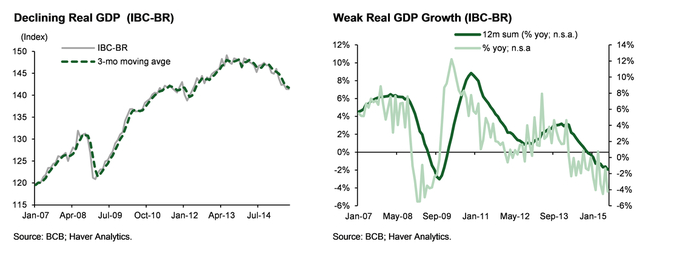

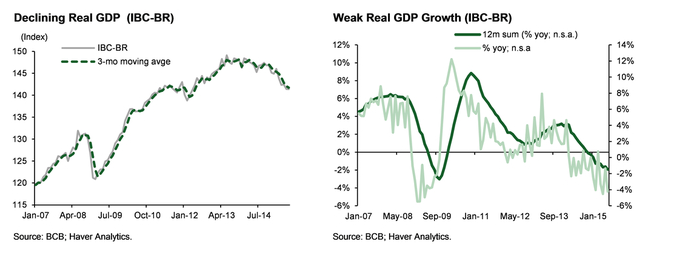

To be sure, emerging markets are for the most part an across-the-board train wreck right now, as a confluence of factors including still-depressed Chinese demand, sluggish global growth and trade, depressed commodity prices, and a looming (supposedly) Fed hike have conspired to push emerging economies from LatAm to AsiaPac to the brink.

That’s no secret and neither is the fact that Brazil was long expected to be the epicenter of any future EM crisis just as it was, in many ways, the picture of EM success during better times.

Having said all of that, the extent to which everything that could go wrong for Brazil did go wrong for Brazil is truly something to behold. Indeed, even we’ve been surprised with the pace at which the situation has deteriorated and in the wake of the S&P downgrade the market is now left to ponder just how much worse things can get and also whether somehow, the embattled government can manage to get its fiscal house in order before the whole thing falls apart completely. On that note, we present the following assessment from Goldman which pretty much sums up the myriad obstacles that lie ahead:

We expect the economy to continue to face headwinds from:

- the ongoing fiscal and quasi-fiscal adjustment

- higher interest rates

- increasingly exigent credit conditions

- rapidly weakening labor market

- higher levels of inventory in key industrial sectors

- higher public tariffs and taxes

- high levels of household indebtedness

- weak external demand

- soft commodity prices

- political uncertainty

- extremely depressed consumer and business confidence.

Oh, is that all?

On the bright side, the BRL’s harrowing decline and an outright lack of demand may ironically serve to limit the downside:

On the positive side, a more competitive exchange rate and weak domestic demand conditions should gradually lift the contribution of net exports to growth and provide a floor for the expected contraction of real GDP in 2015.

Leave A Comment