Income investors are starved for yield in today’s investing environment. It’s not hard to see why:

Thus, when a company like Energy Transfer Equity (ETE) is paying a 7.0% dividend yield, investors tend to take notice. There are currently very few companies that offer the same combination of yield and relative safety as Energy Transfer Partners.

With that said, you can see the full list of 416 companies with 5%+ dividend yields here.

Energy Transfer Partners’ high dividend yield, strong dividend history, and robust growth prospects helped it to rank as a top 10 stock in the most recent edition of the Sure Retirement newsletter. This article will analyze the investment prospects of Energy Transfer Equity in detail.

Business Overview

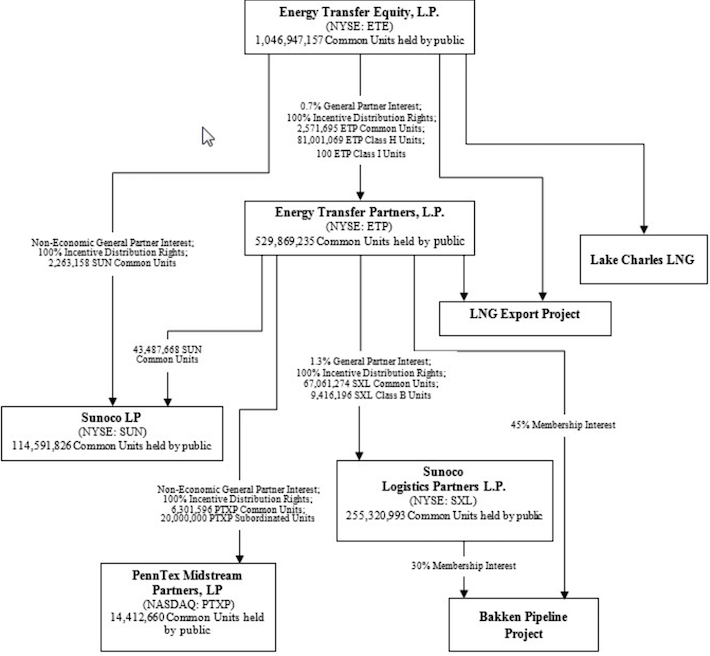

Energy Transfer Equity is essentially an investment holding company with stakes in some of the most well-known master limited partnerships. The company’s business model is summarized succinctly in the following quote from their most recent 10-K.

“The Parent Company’s principal sources of cash flow are derived from its direct and indirect investments in the limited partner and general partner interests in ETP and Sunoco LP, both of which are publicly traded master limited partnerships engaged in diversified energy-related services, and the Partnership’s ownership of Lake Charles LNG.”

Source: Energy Transfer Equity 2016 10-K, page vi

Until recently, the company also had a significant tertiary interest in Sunoco Logistics (SXL), since Energy Transfer Partners owned the general partners of SXL as well as a significantly limited partner stake. The company’s legacy business model can be seen below.

Source: Energy Transfer Equity 2016 10-K, page 1

However, this organizational structure has recently changed. In late April, Energy Transfer Partners merged with Sunoco Logistics. The new entity continues to hold the name Energy Transfer Partners and trades at the price and yield of the legacy Sunoco Logistics security.

Related: What Can Investors Expect From The New Energy Transfer Partners

Leave A Comment