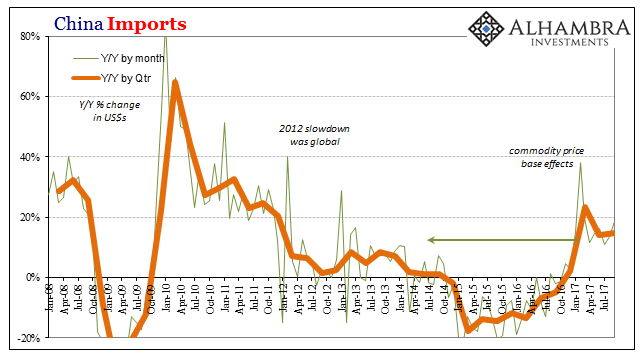

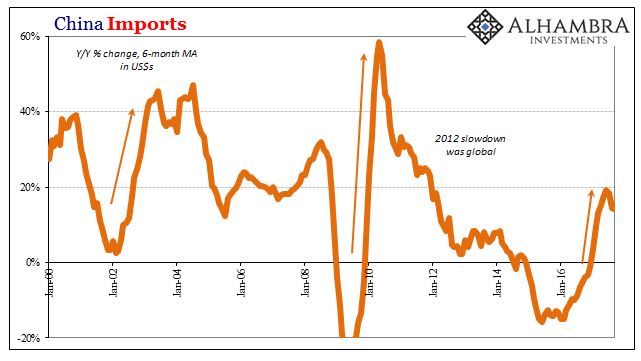

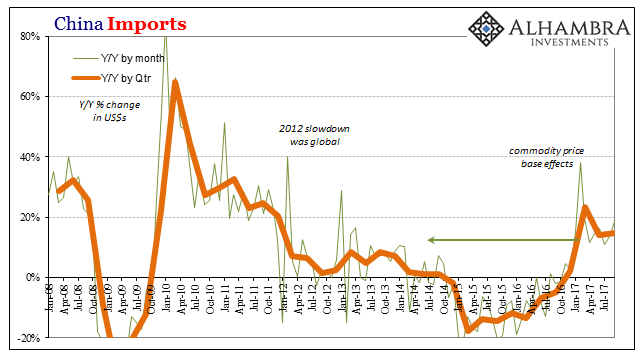

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for imports is backloaded to last year, with little or no momentum carrying forward very far into this year. On a quarterly basis, China’s imports rose by 14.6% in Q3 combined over Q3 2016. That’s basically the same rate as in Q2 (14.2%) and down by a third from Q1’s “reflation”, which was expected to be more than a temporary phenomenon.

Again, those rates sound terrific but come up very small in historical context. At this point in the global recovery from the dot-com recession, imports into China were up more than 40% and would remain at that level for two straight years – more than enough to transition both sides of the eurodollar explosion (the US housing bubble and the Chinese “miracle”) into what looked like global wealth expansion.

Less than 20% growth, following a serious and extended contraction no less, just isn’t going to carry the global economy where “reflation” was supposed to go. The numbers are deceiving outside of context.

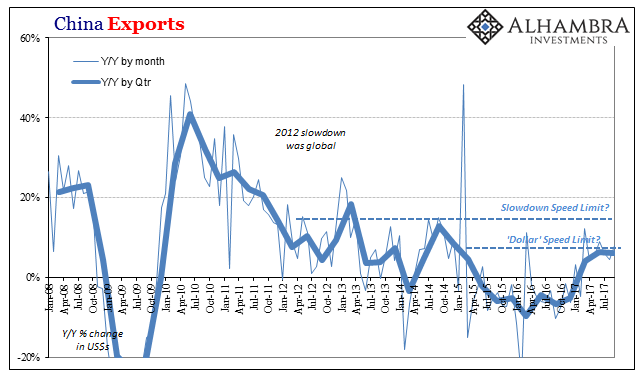

They are much less so on the export side. Chinese outbound trade with the rest of the world expanded just 8% (according to the Customs Bureau, to be revised by NBS) in September. For the quarter as a whole, like imports, Chinese export growth stalled in Q3. Rising by 6.2%, it’s almost exactly the same as Q2 (6.3%) and appreciably less than before the “rising dollar.”

In fact, the rebound in trade, meaning global demand, has been so tame that the total value of China’s exports in September 2017 remained almost 7% less than the total from September 2014 as the “rising dollar” was just getting started. Again we find where the economy gets knocked down for these monetary events and isn’t able to get back up in either absolute or relative growth terms.

Leave A Comment