Two months ago, we looked at historical examples of what happens with the US economy any time corporate profit margins suffer a drop as large as the one experienced over the past 12 months when margins have plunged by (at least) 60 bps. The outcome: a recession on 5 out of 6 prior occasions.

And while the economy is already feeling the recessionary impact of sliding margins as predicted in early October, with the manufacturing ISM printing at its lowest level since the recession, an even more important question is what happens to the stock market now that margins have peaked. On this topic, most have been mum with the usual “answer” being that margins will keep rising. Alas, as even Goldman recently showed they won’t.

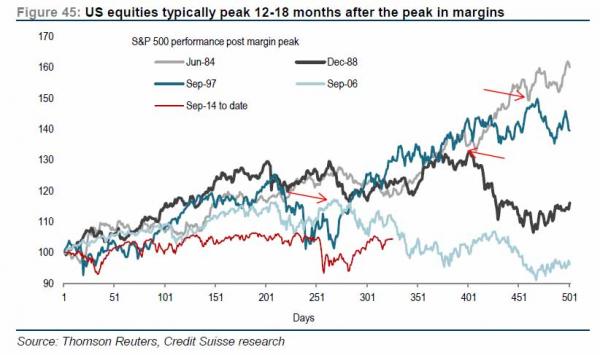

So assuming margins have peaked in this cycle, what does that mean for stocks? For the very simple answer we go to Credit Suisse according to which “equities peak 12-18 months after a peak in margins.”

Where are we now? “we are now 15 months after the peak in margins.”

So, give or take three more months?

Leave A Comment