Idea Credit: Philosophical Economics, but I estimated and designed the graphs

There are many alternative models for attempting to estimate how undervalued or overvalued the stock market is. Among them are:

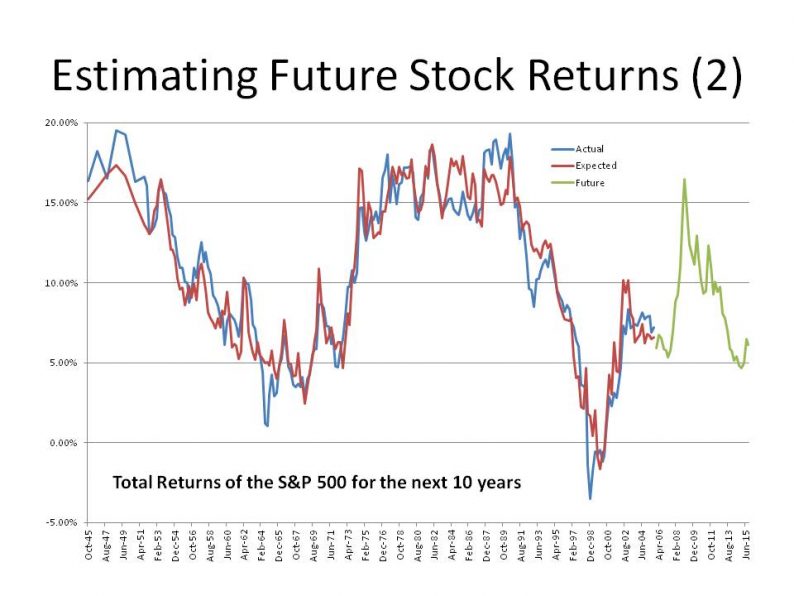

Typically these explain 60-70% of the variation in stock returns. Today I can tell you there is a better model, which is not mine, I found it at the blog Philosophical EconomicsThe basic idea of the model is this: look at the proportion of US wealth held by private investors in stocks using the Fed’s Z.1 report. The higher the proportion, the lower future returns will be.

There are two aspects of the intuition here, as I see it: the simple one is that when ordinary people are scared and have run from stocks, future returns tend to be higher (buy panic). When ordinary people are buying stocks with both hands, it is time to sell stocks to them, or even do IPOs to feed them catchy new overpriced stocks (sell greed).

The second intuitive way to view it is that it is analogous to Modiglani and Miller’s capital structure theory, where assets return the same regardless of how they are financed with equity and debt. When equity is a small component as a percentage of market value, equities will return better than when it is a big component.

What it Means Now

Now, if you look at the graph at the top of my blog, which was estimated back in mid-March off of year-end data, you can notice a few things:

Leave A Comment