Written by Alliance Bernstein

Proponents of credit exchange traded funds (ETFs) claim the last week of market turmoil was a test for these instruments—and that they passed. We think this takes grading on a curve to a new level.

The cheerleaders say ETFs succeeded because they traded regularly after a high-yield mutual fund failed and barred investor withdrawals. Here’s what they’re not telling you: in exchange for this liquidity, investors ended up with instruments that have woefully underperformed active mutual funds—recently and over many years.

For long-term investors who are saving to pay for college or retirement, that’s an awfully steep price to pay for something they don’t really need.

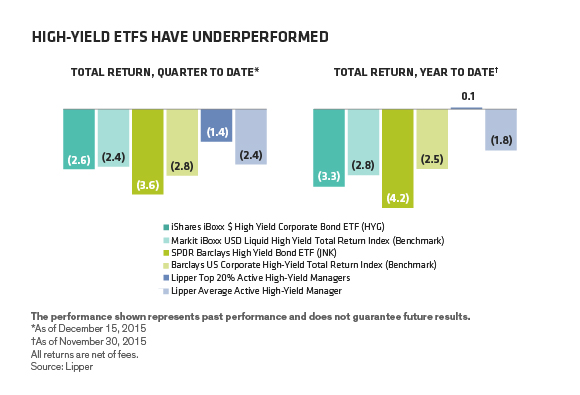

The numbers speak for themselves: Over the first 11 months of this year, the two largest ETFs—HYG and JNK—have sharply underperformed the average active manager, not to mention their own benchmarks. They’ve also trailed the average active manager so far in the fourth quarter (Display) and since the start of December, one of the year’s most volatile months so far.

ETFs’ longer-term performance falls short, too. In fact, not only have active managers outpaced ETFs over the long run, they’ve done it with lower volatility, as measured by risk-adjusted returns. The Sharpe ratio, which measures return per unit of risk, was 0.45 for JNK and 0.51 for HYG between February 2008, shortly after they began trading, and November of this year. For the top 20% of active high-yield managers, it was 0.71.

How Much Liquidity Is Enough?

Is the ability to get in or out of an ETF at any point in the day worth the underperformance? For asset managers and traders who need to trade frequently to hedge positions, maybe. After all, they’re not investing in these instruments as long-term income generators.

But a large share of the people who own high-yield ETFs aren’t traders. They’re regular folks saving for college, or to buy a new home, or for retirement. In other words, they’re investors, not traders. Most probably aren’t doing any intraday trading at all. If they’re buying ETFs for the liquidity, they’re paying—dearly—for something they don’t need.

Leave A Comment