Sadly, my July forecast that US-China tariffs could lead to a global polyethylene price war seems to be coming true.

As I have argued since March 2014 (US boom is a dangerous game), it was always going to be difficult for US producers to sell their vastly increased output. The expansions were of course delayed by last year’s terrible hurricanes, but the major plants are all now in the middle of coming online. In total, these shale gas-based expansions will increase ethylene (C2) capacity by a third and polyethylene (PE) capacity by 40% (6 million tonnes).

ICIS pricing reports this weekend confirm my concern, following China’s decision to retaliate in response to President Trump’s $200bn of tariffs on US imports from China:

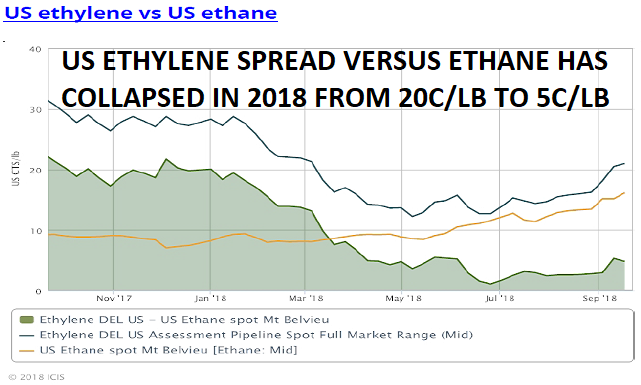

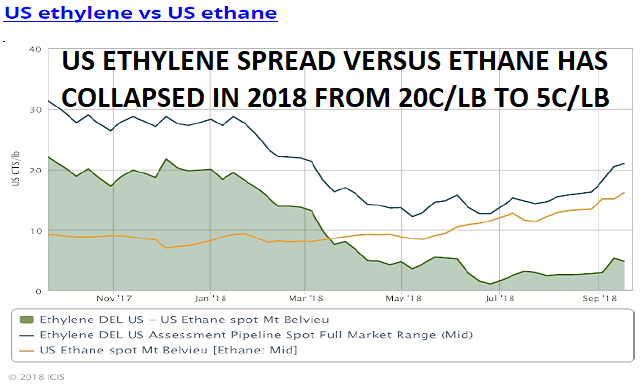

Even worse, as the chart above confirms, is that US ethane feedstock spreads versus ethylene have collapsed during 2018, from around 20c/lb to 5c/lb today. Ethane averaged 26c/gal as recently as May, but spiked to more than double this level earlier this month (and even higher, momentarily) at 55c/gal.

The issue appears to be that US producers had calculated their ethane supply/demand balances on the basis of the planned US expansions, and never expected large volumes of ethane to be exported. Yet the latest EIA data shows exports doubling from an average 95kbd in 2016 to 178kbd last year. And they are still rising, with Q2 exports 62% higher at 290kbd.

Leave A Comment