EU Session Bullet Report

Asian markets came under pressure early this morning following soft economic data from China. Markets remain on edge as investors wait to see what the U.S Federal Reserve decides regarding interest rates later this week.

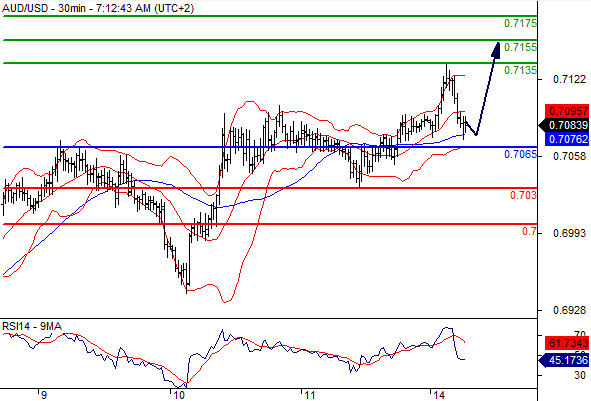

AUDUSD continued its recovery of the last 2 weeks, touching a 2 week high at 0.7134 before retracing back to 0.7080 at time of writing.

On Friday, Gold closed down for the third consecutive week as investors show little interest in the shiny metal.

Oil also remains under pressure and remains below $45 as low demand continues to keep its price down.

News wise, there is no major data today so markets may be driven by technicals as investors seek insight on what the Fed will decide on Thursday.

Trading quote of the day:

“You don`t need to be a weatherman to know which way the wind blows”

– Bob Dylan

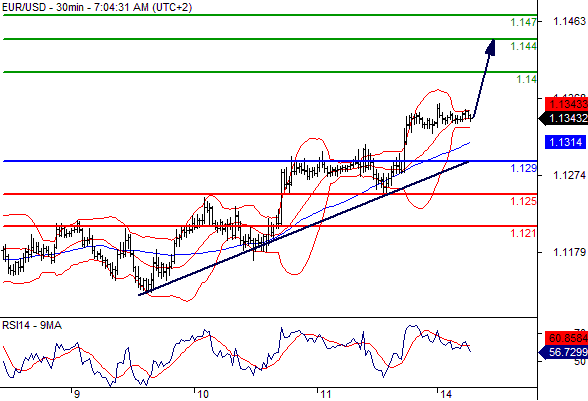

EURUSD

Pivot: 1.129

Likely scenario: Long positions above 1.129 with targets @ 1.14 & 1.144 in extension.

Alternative scenario: Below 1.129 look for further downside with 1.125 & 1.121 as targets.

Comment: The RSI lacks downward momentum. The prices remain supported by a rising trend line.

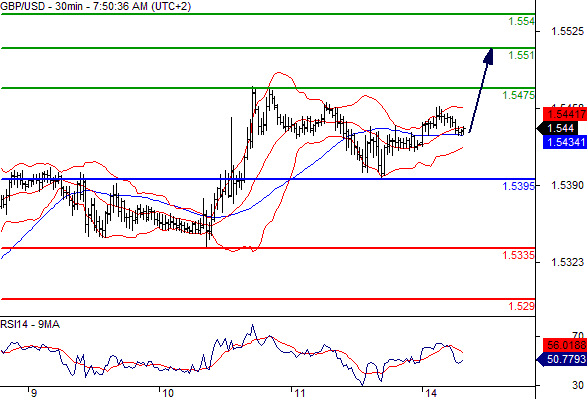

GBPUSD

Pivot: 1.5395

Likely scenario: Long positions above 1.5395 with targets @ 1.5475 & 1.551 in extension.

Alternative scenario: Below 1.5395 look for further downside with 1.5335 & 1.529 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

AUDUSD

Pivot: 0.7065

Likely scenario: Long positions above 0.7065 with targets @ 0.7135 & 0.7155 in extension.

Alternative scenario: Below 0.7065 look for further downside with 0.703 & 0.7 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

USDJPY

Pivot: 120.95

Likely scenario: Short positions below 120.95 with targets @ 119.9 & 119.6 in extension.

Alternative scenario: Above 120.95 look for further upside with 121.3 & 121.75 as targets.

Comment: As long as 120.95 is resistance, expect a return to 119.9. The pair has broken below its intraday rising trend line.

Leave A Comment