EU Session Bullet Report

Another start of the week with key news to be released from over the world. Overnight in Asia Chinese data where not shockingly off expectations. GDP growth slowed to 6.9% slightly below 7% which is the government’s target. Industrial production slowed to 5.7% compared to 5.4% which was at the time of the global financial crisis in 2007. Asia markets opened the week mildly lower as a result. Today is a very thin calendar as the US will only release housing data, however the week features key events such as the ECB policy rate decision as well as Canada releasing Retail sales, CPI and a rate decision.

Last week’s economic data were weak; in the US, September retail sales disappointed, suggesting that momentum is slowing, while industrial production declined in Europe in August, in line with expectations. Despite the above, global stock markets managed to close with slight gains making it the 3rd straight week of gains for the US markets.

Trading Quote of the Day:

“We must remove the emotional element as quickly as possible in trading. If you can do it before you put on a position, you have a good start.”

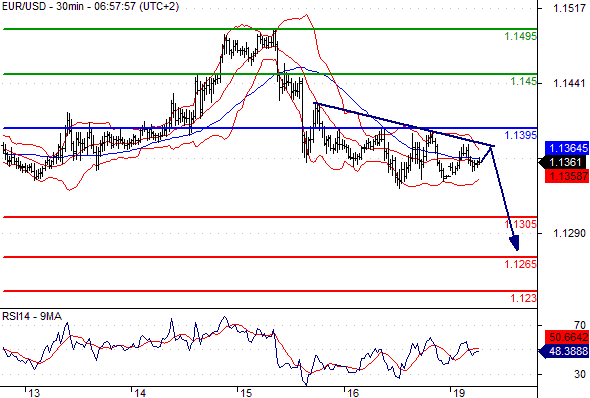

EURUSD

Pivot: 1.1395

Likely scenario: Short positions below 1.1395 with targets @ 1.1305 & 1.1265 in extension.

Alternative scenario: Above 1.1395 look for further upside with 1.145 & 1.1495 as targets.

Comment: The pair is capped by a declining trend line.

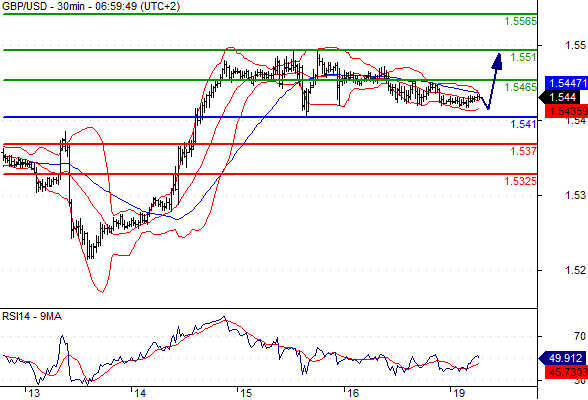

GBPUSD

Pivot: 1.541

Likely scenario: Long positions above 1.541 with targets @ 1.5465 & 1.551 in extension.

Alternative scenario: Below 1.541 look for further downside with 1.537 & 1.5325 as targets.

Comment: A support base at 1.541 has formed and has allowed for a temporary stabilisation.

AUDUSD

Pivot: 0.7305

Likely scenario: Short positions below 0.7305 with targets @ 0.724 & 0.7225 in extension.

Alternative scenario: Above 0.7305 look for further upside with 0.7345 & 0.738 as targets.

Comment: As long as the resistance at 0.7305 is not surpassed, the risk of the break below 0.724 remains high.

Leave A Comment