EU Session Bullet Report – New highs for the USD ahead of the big day

Get ready for the big day. Today is all about the ECB and Mario Draghi’s express delivery of unconventional methods to revive the EU economy. At 12:45 GMT, the rate decision takes place, where it is expected that Draghi will announce even a 0.2% rate cut, accompanied by an extension of the QE program to December 2016. Markets have these factors priced in, so in case the measures are more drastic, then EURUSD could crash even further. A test of 1.0450 today cannot be excluded. On the other hand, if the ECB fails to impress, then a gradual recovery to 1.0880 is also possible. In the US, last night Fed chairwoman Janet Yellen, reconfirmed the readiness to hike rates in December also based on the recovery of the employment sector, inflation being above what PCE readings show as its held down by temporary factors (low oil prices as well as a strong USD and diminishing concerns over emerging economies (China). Probability for a rate hike this month remains around 75%.

Market wise, yesterday there were lots of developments. USD index hit a new high, as EURUSD reached a new post April low at 1.0550. OIL fell briefly under $40 a barrel (first time since August) while GOLD continued its downfall and hit a new 6 year low at $1045. USDCAD was volatile, after Canadian Central Bank left rates unchanged at 0.5% for a 5th consecutive meeting. ECB rate decision and press conference is the major focus today.

Trading quote of the day:

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful. – Warren Buffett

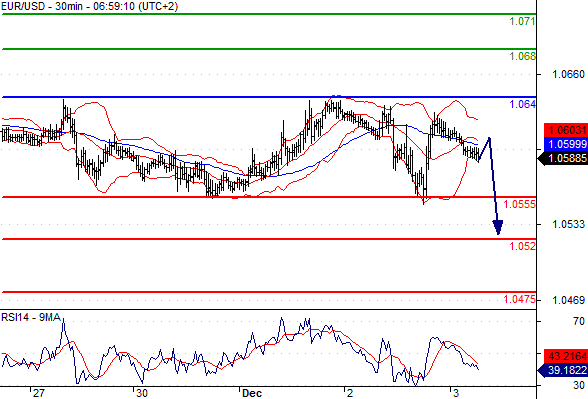

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.064

Likely scenario: Short positions below 1.064 with targets @ 1.0555 & 1.052 in extension.

Alternative scenario: Above 1.064 look for further upside with 1.068 & 1.071 as targets.

Comment: The RSI is badly directed.

GBP/USD

Pivot: 1.5005

Likely scenario: Short positions below 1.5005 with targets @ 1.4895 & 1.4855 in extension.

Alternative scenario: Above 1.5005 look for further upside with 1.505 & 1.5095 as targets.

Comment: The RSI is badly directed.

Leave A Comment