Commodities dropped on the back of yesterday’s weak Chinese GDP growth (slowest since the financial crisis) data. Industrial production signals a falling Chinese demand, which contributed to lower oil and gold prices. The US dollar has strengthened somewhat after Fed’s Williams said that he saw the time to start raising rates in the near future. Overall market action is muted though, as traders await for the long anticipated ECB rate decision and conference on Thursday. Canada, saw its currency drop a bit versus the USD following the liberal Party win in the national election while AUDUSD gained after the RBA minutes from the October 6 rate decision, confirmed the fact that the bank sees no urgent need to reduce rates further,

Apart from speeches from Fed’s Dudley, Powel and Fed Chair Yellen this afternoon, Switzerland will release trade balance and Germany will release PPI. In the US session, US will release housing starts and building permits while Canada will release wholesale sales.

Trading Quote of the Day:

“Have the patience to wait, the courage to get out and the integrity to follow your plan”

– John Carter

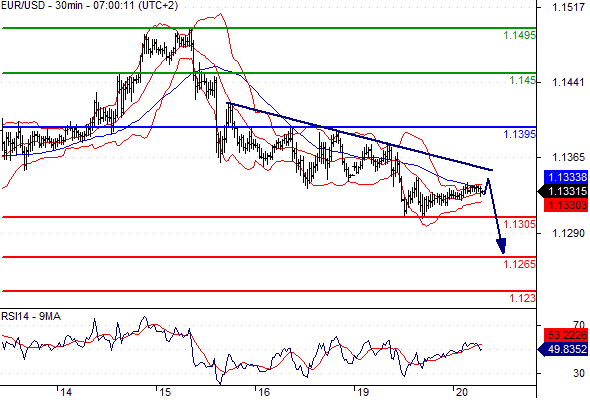

Green lines are resistance, Red lines are support

EUR/USD

Pivot: 1.1395

Likely scenario: Short positions below 1.1395 with targets @ 1.1305 & 1.1265 in extension.

Alternative scenario: Above 1.1395 look for further upside with 1.145 & 1.1495 as targets.

Comment: A break below 1.1305 would trigger a drop towards 1.1265.

GBP/USD

Pivot: 1.541

Likely scenario: Long positions above 1.541 with targets @ 1.551 & 1.5565 in extension.

Alternative scenario: Below 1.541 look for further downside with 1.537 & 1.5325 as targets.

Comment: The RSI is well directed.

AUD/USD

Pivot: 0.7305

Likely scenario: Short positions below 0.7305 with targets @ 0.724 & 0.7225 in extension.

Alternative scenario: Above 0.7305 look for further upside with 0.7345 & 0.738 as targets.

Comment: Even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Leave A Comment