The big economic number next week will be the Q3 Advance Estimate for GDP on Wednesday the 28th at 8:30 AM ET. With the volatile first two quarters behind us with their real annualized rates of 0.6% in Q1 and

October 20, 2015

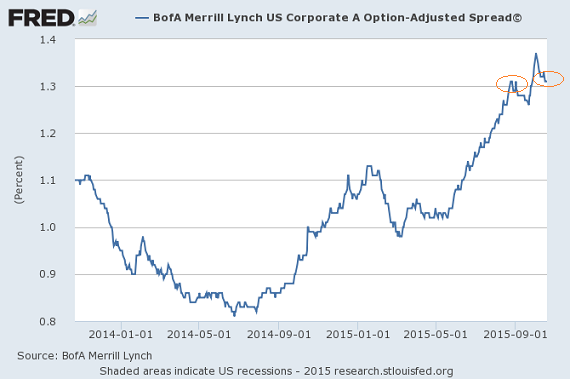

Is the worst behind us? Maybe. Yet the appetite for risk is decidedly less vibrant than before the August-September meltdown. (Review Market Top? 15 Warning Signs.) Consider high-quality bonds as represented by the Bank of America Merrill Lynch US Corporate A Option-Adjusted Spread. The yield spread between