Yesterday the ECB kept rates unchanged however the EURUSD dropped after Mario Draghi downgraded growth as well as inflation expectations and hinted that the ECB is ready to add further QE in order to stimulate growth. EURUSD fell to 1.1080 from over 1.1240.

Overnight, JPY crosses were hit hard as a resumption of falling stock markets emerged again. USDJPY lost over 100 pips and is trading at 119.20. AUDUSD was also on the back foot and hit a new 6, 5 year low at 0.6959.

The torch is now passed to NFP at 12:30 GMT. Market participants will be watching closely to see if the job sector in the US is strong enough for the FED to justify a rate hike. A weak number (below 200,000) would quite possibly rule out a September rate hike. . The market is predicting a 218,000 increase in jobs in August, which is pretty close to the average over the past six months, as well as to the reading from July.

Trading Quote of the Day:

“anybody who says that money is the root of all evil, doesn’t have any”

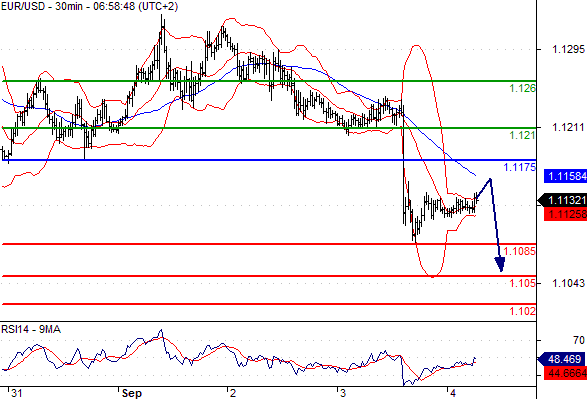

EURUSD

Pivot: 1.1175

Likely scenario: Short positions below 1.1175 with targets @ 1.1085 & 1.105 in extension.

Alternative scenario: Above 1.1175 look for further upside with 1.121 & 1.126 as targets.

Comment: The RSI is mixed to bearish.

GBPUSD

Pivot: 1.529

Likely scenario: Short positions below 1.529 with targets @ 1.5215 & 1.5165 in extension.

Alternative scenario: Above 1.529 look for further upside with 1.534 & 1.538 as targets.

Comment: The RSI is badly directed.

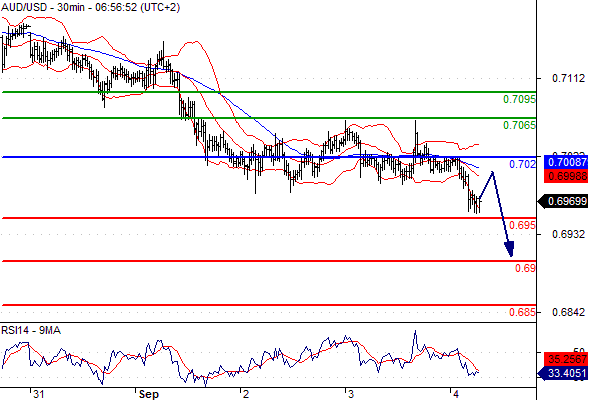

AUDUSD

Pivot: 0.702

Likely scenario: Short positions below 0.702 with targets @ 0.695 & 0.69 in extension.

Alternative scenario: Above 0.702 look for further upside with 0.7065 & 0.7095 as targets.

Comment: The RSI is badly directed.

USDJPY

Pivot: 120.2

Likely scenario: Short positions below 120.2 with targets @ 118.85 & 118.4 in extension.

Alternative scenario: Above 120.2 look for further upside with 120.65 & 121.05 as targets.

Comment: The RSI is bearish and calls for further downside.

Leave A Comment