EU Session Bullet Report

The Dollar Index surge from Friday was halted Sunday and Monday morning, as the rally takes a breather. Last Friday news that China has cut its interest rates for the 6th time, boosted Stock markets and USD to levels not seen since months. This morning, the USD weakness has continued but was limited to AUD and NZD. In other currencies gains are limited, with the USD trading on a back foot for the moment.

It is a busy week with a lot of key economic announcements expected. Today IFO institute will Report sentiment on German Business climate and US will release new home sales. On Wednesday, investors will focus on the monetary policy announcement from the FED for fresh indications on the timing of the initial rate hike.

Last week, the EUR bottomed versus USD after ECB President discussed lowering the deposit rate and added that the European Central Bank could increase its asset purchasing programme (QE).

Trading Quote of the Day:

“The size of greatness inside of you is measured by the challenges you overcome.”

Green lines are resistance, Red lines are support

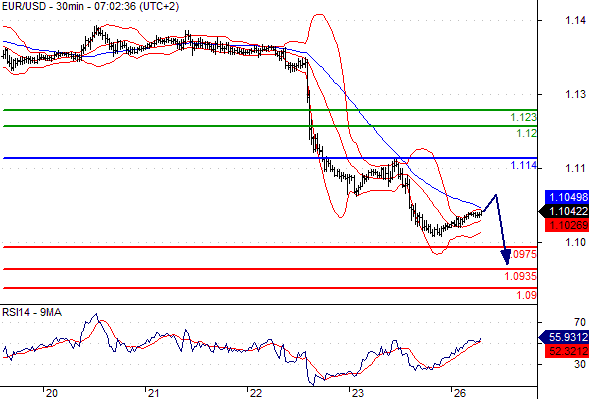

EURUSD

Pivot: 1.114

Likely scenario: Short positions below 1.114 with targets @ 1.0975 & 1.0935 in extension.

Alternative scenario: Above 1.114 look for further upside with 1.12 & 1.123 as targets.

Comment: Even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

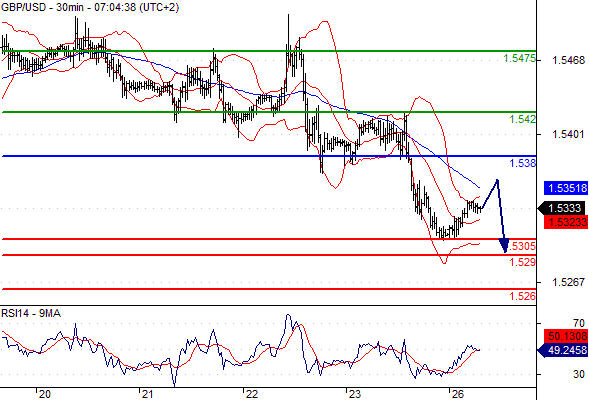

GBPUSD

Pivot: 1.538

Likely scenario: Short positions below 1.538 with targets @ 1.5305 & 1.529 in extension.

Alternative scenario: Above 1.538 look for further upside with 1.542 & 1.5475 as targets.

Comment: Even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

AUDUSD

Pivot: 0.7195

Likely scenario: Long positions above 0.7195 with targets @ 0.7305 & 0.7345 in extension.

Alternative scenario: Below 0.7195 look for further downside with 0.716 & 0.7135 as targets.

Comment: The RSI is well directed.

Leave A Comment