EU Session Bullet Report

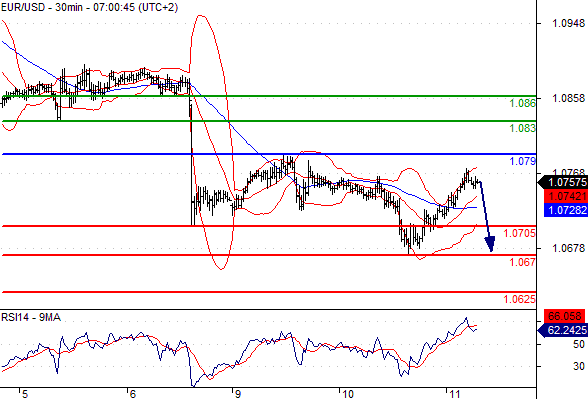

As the US markets approach a US holiday (veterans day) , the Dollar rally is taking a breather. EUR/USD is recovering from a 7 month low of 1.0674 as it is trading around 1.0750 just before the EU open however the bias is still on the downside. Resistance lies at 1.0770.

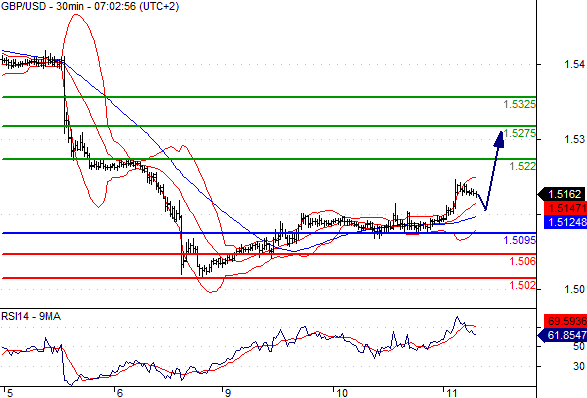

Same picture for the Cable which jumped in Asia, to 1.5186 from 1.5118. All eyes are on today’s jobs data which could define mid-term direction for the GBP/USD. For the moment, rate hike expectations for UK are set on mid-year 2016.

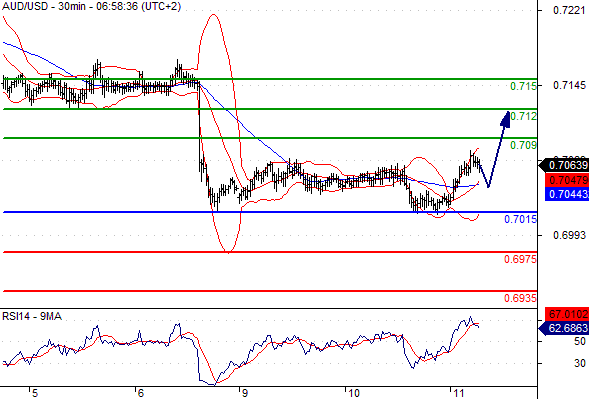

Meanwhile AUD sees little change after weaker than expected Chinese data, remaining largely unchanged around 0.76065 after China data showed slowdown in factory output.

Calendar wise, as it is a US, Canada and French Market Holiday, the biggest news are UK unemployment data.

Trading Quote of the day:

You will always remember the trades that could have been and forget about the risks that were involved.

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.079

Likely scenario: Short positions below 1.079 with targets @ 1.0705 & 1.067 in extension.

Alternative scenario: Above 1.079 look for further upside with 1.083 & 1.086 as targets.

Comment: The upward potential is likely to be limited by the resistance at 1.079.

GBP/USD

Pivot: 1.5095

Likely scenario: Long positions above 1.5095 with targets @ 1.522 & 1.5275 in extension.

Alternative scenario: Below 1.5095 look for further downside with 1.506 & 1.502 as targets.

Comment: The RSI is well directed.

AUD/USD

Pivot: 0.7015

Likely scenario: Long positions above 0.7015 with targets @ 0.709 & 0.712 in extension.

Alternative scenario: Below 0.7015 look for further downside with 0.6975 & 0.6935 as targets.

Comment: The RSI is well directed.

USD/JPY

Pivot: 122.65

Likely scenario: Long positions above 122.65 with targets @ 123.6 & 124 in extension.

Alternative scenario: Below 122.65 look for further downside with 122 & 121.6 as targets.

Comment: A support base at 122.65 has formed and has allowed for a temporary stabilisation.

Leave A Comment