With the wild swings in EUR/USD came big moves for EUR/GBP on Friday but when the dust settled, sterling outperformed the euro and we think this move will last. The European Central Bank’s monetary policy announcement is less than 2 weeks away. Between now and then, the only thing that investors will be thinking about is whether it will be a hawkish or dovish taper. Based on last week’s mostly better than expected economic reports, the ECB should reduce asset purchases and pave the way for tighter policy. However between Spain’s political troubles (which are no closer to being resolved) and the high level of the exchange rate, ECB officials have stressed that policy will remain extremely accommodative which suggests that their preference for a dovish taper. The longer the market feels that way, the greater the pressure on the euro. In contrast, sterling was this past week’s best performing currency. Now that Prime Minister May’s troubles seem to be fading and the EU’s Chief Negotiator suggested that they could provide the 2 year Brexit transition that she’s been asking for, a soft Brexit and prospects of a year end rate hike have returned to take sterling higher. Next week is an important one for the U.K. because there are a number of key economic reports on the calendar that will play a major role in hardening or weakening the BoE’s case for tightening. Inflation, employment and consumer spending numbers are scheduled for release and we are mostly looking for stronger data that should drive GBP even higher.

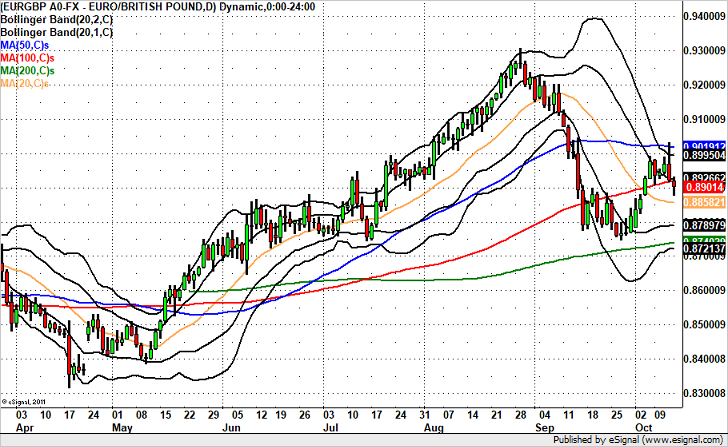

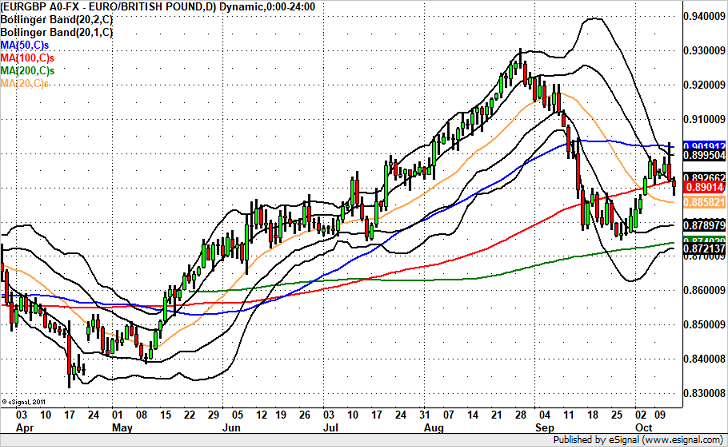

On a technical basis, after breaking below the 100-day SMA, EUR/GBP spent the last 24 hours trading firmly below this key support turned resistance level. We now believe that the pair will fall to at least 0.8850, the 20-day SMA and more likely to the first standard deviation Bollinger Band at 0.8800.

Leave A Comment