The EUR/USD ended the day at its lows after hitting a high of 1.1961. A reversal as strong as today’s is generally a precursor to further weakness. While it is difficult to say what caused the currency’s underperformance, 1.1975 was about the level where ECB President Draghi described currency moves as volatile. Back in September when EUR/USD was trading near 1.1975, he said “the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring.” We doubt this view has changed given Germany’s political troubles and the low level of inflation but that along with the weakness of German yields are the main reasons for the euro’s underperformance. The technical structure of the pair now signals a deeper correction to at least 1.1850, which is why we like selling euros. However we have chosen to sell EUR vs. the Japanese Yen because we believe that tomorrow’s economic reports will add additional pressure to USD/JPY. We also expect more pushback on tax reform before an agreement that leads to a floor vote. Jerome Powell also faces a nominee hearing on Tuesday and while he has never dissented from a Fed decision, he has a reputation of being dovish on monetary policy.

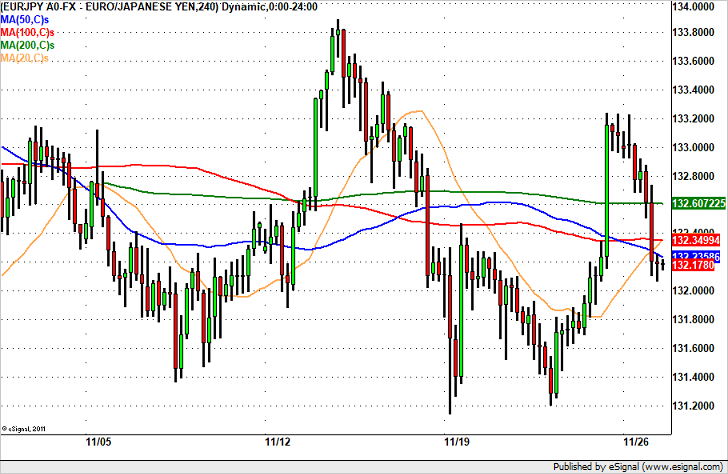

Technically, EUR/JPY sold off sharply on Monday but it is the abundance of moving average resistance on the 4 hour chart that makes it a particularly attractive sell. There’s no major support until the November 19th low of 131.14.

Leave A Comment