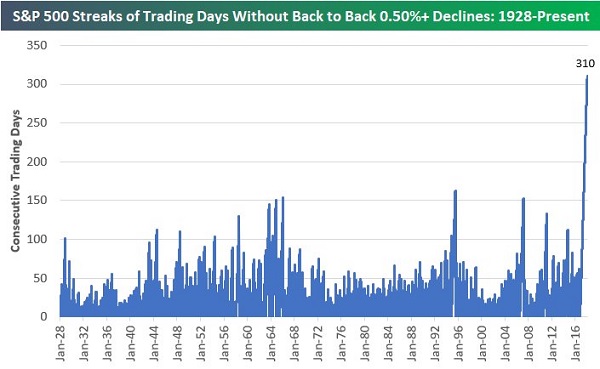

The U.S. stock market has rarely notched 150 trading days without back-to-back 0.5%-plus declines. It happened on one occasion prior to the financial crisis in 2007. It also occurred once in the mid-1990s and twice in the 1960s.

More recently, the S&P 500 logged an additional streak for consecutive trading sessions. This time, however, 150 days did not serve as the high-water mark. Nor was it 200 or 250 days.

The new record streak that culminated on January 30, 2018? Try 300-plus consecutive sessions without back-to-back 0.5%-plus declines. That’s more than DOUBLE anything witnessed across the last 90 years.

Many media personalities describe the current stock equanimity in terms of a paradigm shift. I do not. Just as a “New Economy” failed to justify the insanity of the 2000 stock bubble at the turn of the century, the recent suppression of market volatility does not represent a permanent plateau of higher prices.

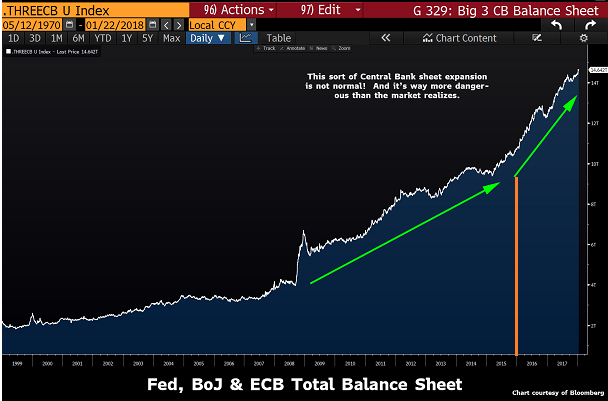

One of the primary reasons for the extended period of market calm has been the influence of central bank asset purchases (a.k.a. “QE” or “quantitative easing”). As the world found itself on the precipice of bearish stock price decimation two years ago (01/16), global central banks supercharged their stimulus by injecting trillions of additional liquidity.

Keep in mind, there is an exceptionally high correlation between the pace of central bank balance sheet expansion and stock prices. Specifically, the faster the rate of balance sheet growth, the higher prices have climbed on very little volatility. The slower the rate of balance sheet growth, or the absence of growth altogether, the less success stocks have had.

Creating a wealth effect where higher asset prices might lead businesses and households toward greater consumption is precisely what central banks around the world set out to do. Unfortunately, by the second half of 2018, Federal Reserve and European Central Bank net purchasing activity will turn negative. This places a whole lot of pressure on the tax reform package to pick up the stimulus slack.

Leave A Comment