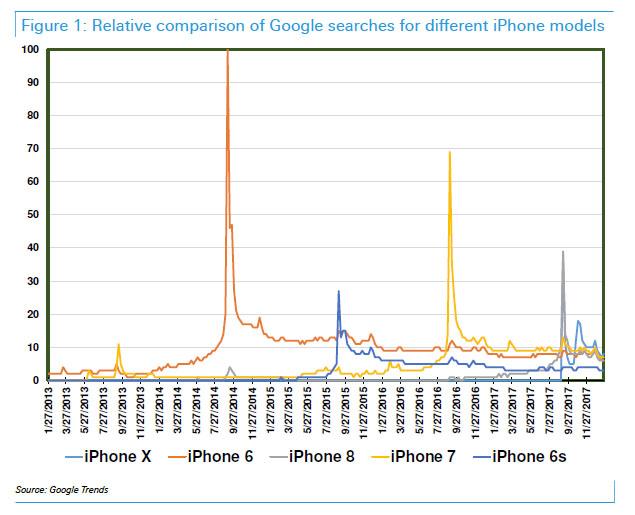

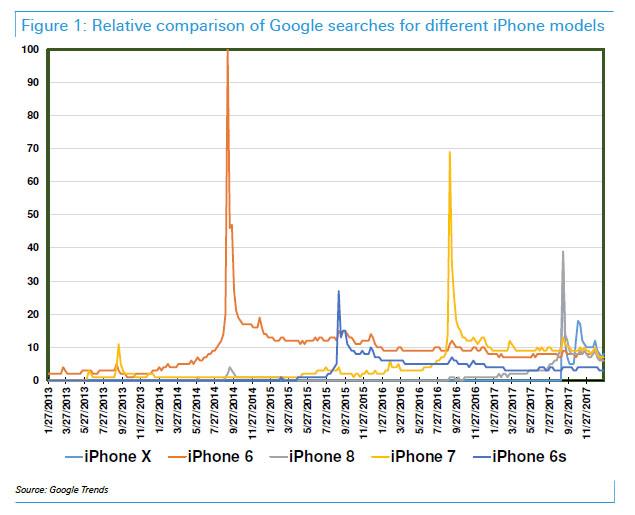

When it comes to Apple, it has become almost apocryphal to suggest that the world’s most valuable company whose (offshore but not for long) cash hoard is bigger than the GDPs of most countries, owes its nearly $1 trillion market cap to anything less than the stellar success of its products, by which we of course mean the iPhone. And yet, as one bank after another has cautioned in recent weeks – Deutsche Bank most recently – Apple’s magic goose may no longer be laying “supercycle” eggs, now that the iPhone X is officially a dud, with Cupertino quietly ordering production to be slashed as much as 50% following a historic gamble: the price of its latest gadget was just too high, leading to a plunge in interest.

Now, as Deutsche observed, Apple’s shares were up 46% in 2017, significantly outperforming the markets. This outperformance came from the iPhone X/8 anticipation trade, with much of this upside coming early in the year as investors got excited about the new iPhone X. The problem is that in light of the mediocre demand for the iPhone X – whether due to price or some other reason – investors clearly got ahead of themselves, and while virtually everyone id HODLing AAPL for now, once Tim Cook is forced to guide down, things may get ugly.

There is another problem, and this goes beyond the company’s business and operational decisions.

As the German bank shows, the other key driver of Apple’s strong performance in 2017 was the overall market’s strong performance. The S&P 500 was up 19% in 2017, while the NASDAQ was up 28%. Apple accounts for 4% of the S&P 500, which means that passive investors need to own a decent-sized portion of Apple shares in order to perform in line with the market.

But the real punchline is ETFs, and specifically how greatly the inflow into passive strategies has boosted Apple’s stock price, for no other reason than simply because retail investors wanted equity exposure via market ETFs!

Leave A Comment