Fundamental Forecast for EUR/USD: Neutral

– EUR/USD is a credible threat to breakout if the USDOLLAR Index loses its floor.

– Twenty year seasonality trends favor a stronger EUR/USD in April.

– Read the EUR/USD quarterly forecast, “EUR/USD Stuck in No Man’s Land’s Headed into Q2’16 – Don’t Discount ‘Brexit’”

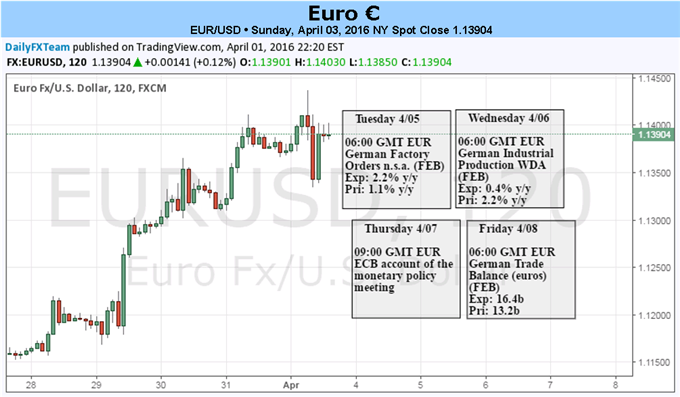

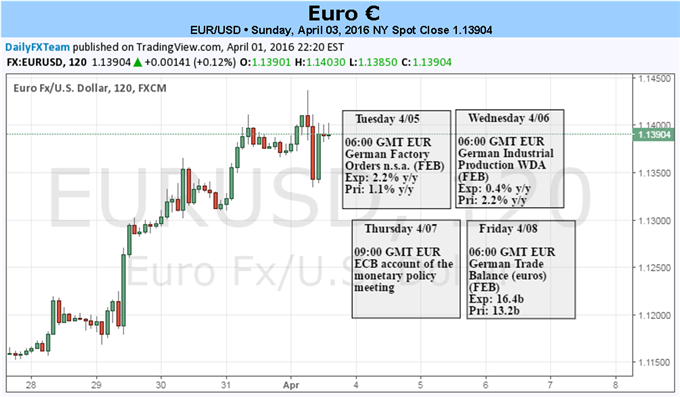

The Euro had what one might consider to be a fairly typical week amid a slide in global equity markets, with EUR/JPY losing -3.28%, while EUR/AUD and EUR/NZD rallied by +1.65% and +1.45%, respectively. While all focus was on the Japanese Yen and the apparent failings of the Bank of Japan’s monetary policy, few seem to be talking about the upcoming European Central Bank policy meeting on April 21. Now less than two weeks, traders may find the run-up to the meeting to be rather uninspiring.

For the ECB, there’s really not much to do right now. The expanded QE program just went into effect on April 1. The TLTROs and thus, the lower interest rate policy regime, have yet to; and their impact won’t be able to be measured for several months (for their impact on the real economy). With the FX channel no longer being targeted explicitly, it seems the Euro has been given some clearance to strengthen. The question is, just how far?

EUR/USD has already rallied from around $1.0800 on the day of the March 20 ECB meeting to above $1.1450 last week, yet the ECB has been quiet on the issue. With the ECB’s 2016 technical assumption for EUR/USD at $1.0900, it would seem that that as we near the +5% level, the ECB may be more inclined to speak up (as was the case when the EUR/USD’s 2015 technical assumption was $1.1100-1.1200).

The door for more action isn’t closed – the recent ECB minutes revealed as much – but it seems that the more likely outcome would be for another rate cut rather than more QE. This may be part of the reason why the Euro hasn’t been able to rally during this latest bout of market turmoil and US Dollar weakness: rates markets are pricing leaning towards another rate cut by the end of this year (chart below).

Leave A Comment