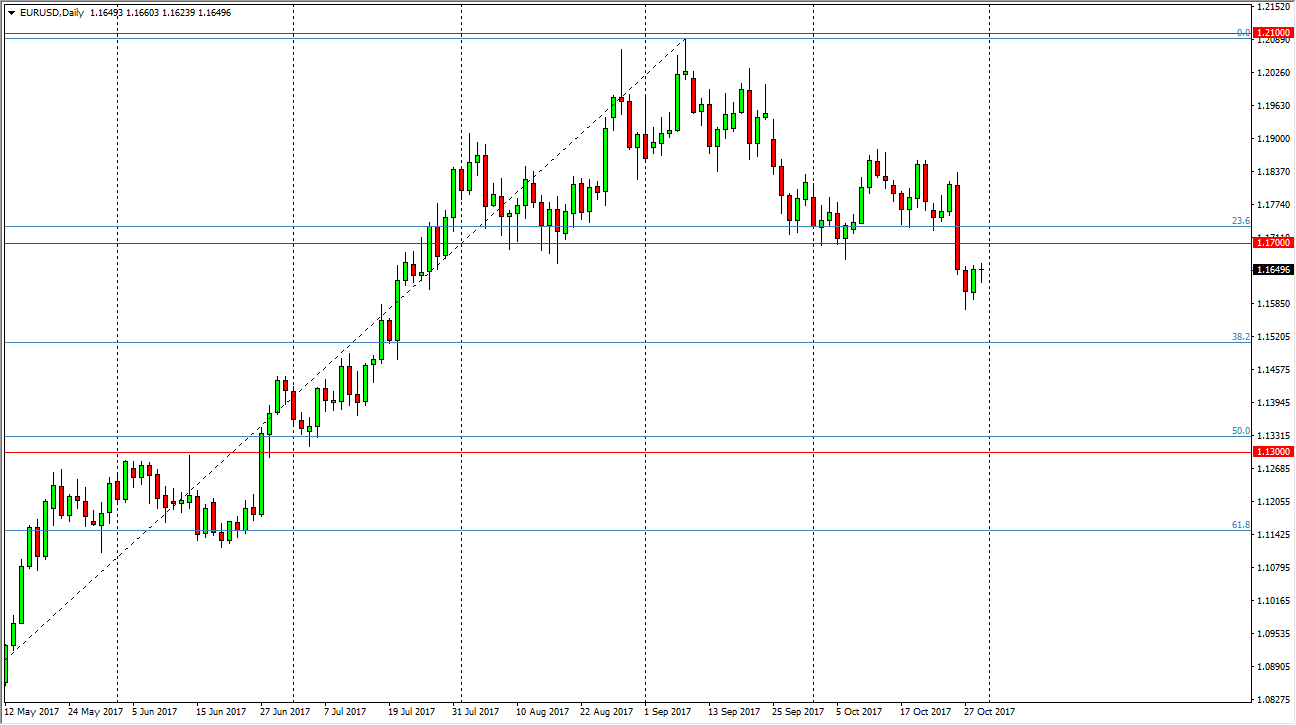

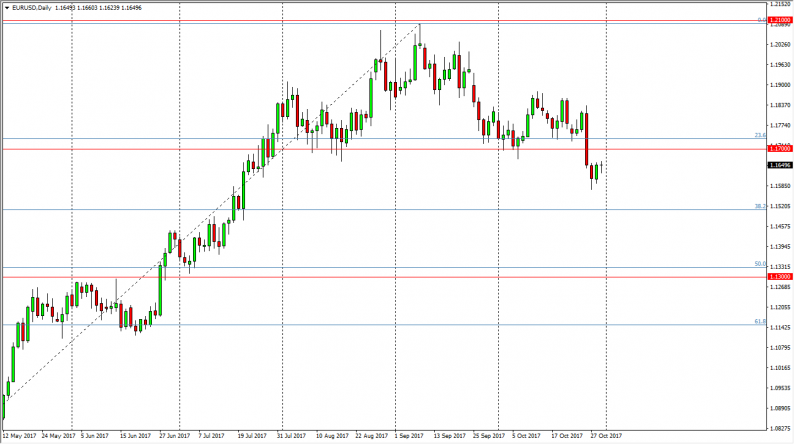

EUR/USD

The EUR/USD pair fell initially during the day on Tuesday but found enough support underneath to turn around and show signs of support. I think the 1.17 level of course is resistive above, as it was a neckline from the head and shoulders pattern. If we were to close above there, and perhaps more importantly, above the 1.1750 level, then I believe that the pattern has been negated, and is very likely that the buyers will push this market towards the 1.20 level, perhaps even the 1.21 level after that. As things stand now though, I believe that the downside is more likely to be pursued, and a breakdown from here should fulfill the move to the 1.13 level eventually. Ultimately, I think you can expect a lot of volatility.

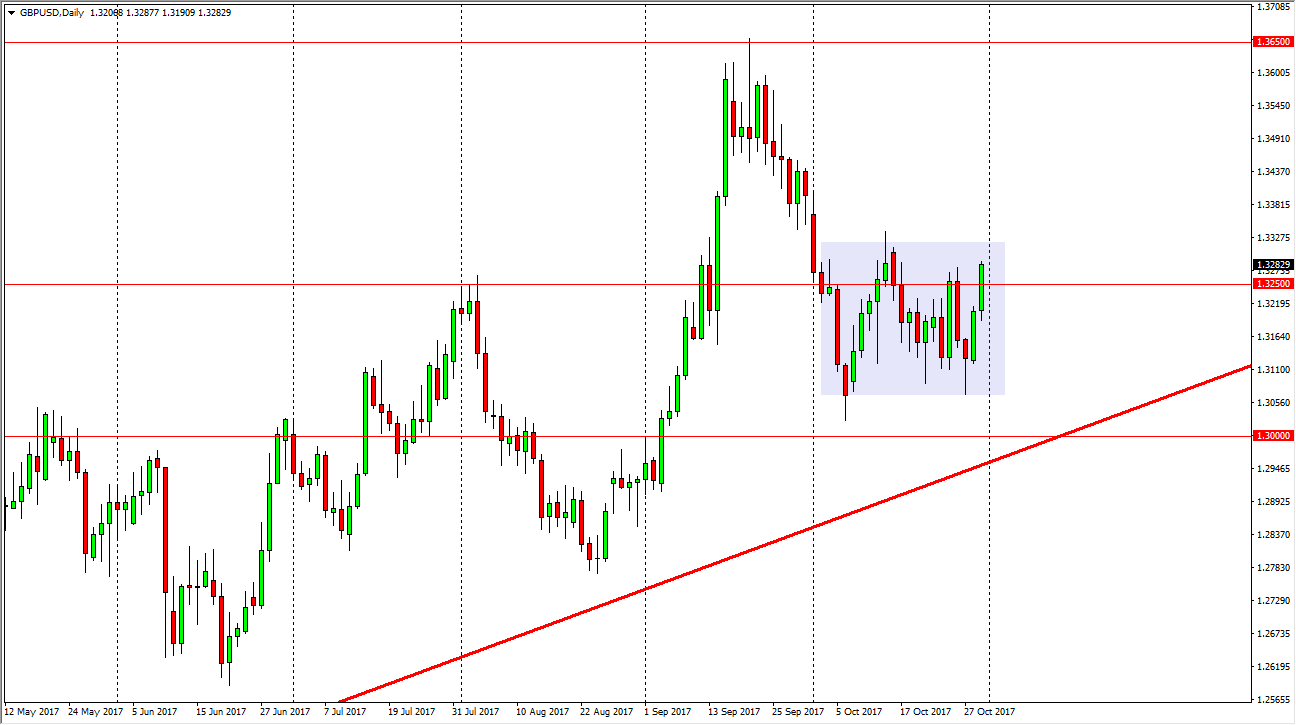

GBP/USD

The British pound initially fell during the trading session on Tuesday but broke above the 1.3250 level. This is a bullish sign, and I think we are getting ready to go higher. A move above the 1.33 level should send this market to the 1.35 handle next. Remember, the economy and the United Kingdom is starting to heat up, showing signs of inflation. This means that the Bank of England will probably have to raise interest rates, even though the Federal Reserve continues to look likely to raise interest rates as well. If we can break above the 1.35 level, then the market goes to the 1.3650 level above. A clearance of that market sends the British pound much higher levels, perhaps near the 1.40 level. It’s not until we break down below the 1.30 level that I would consider selling this market.

Leave A Comment