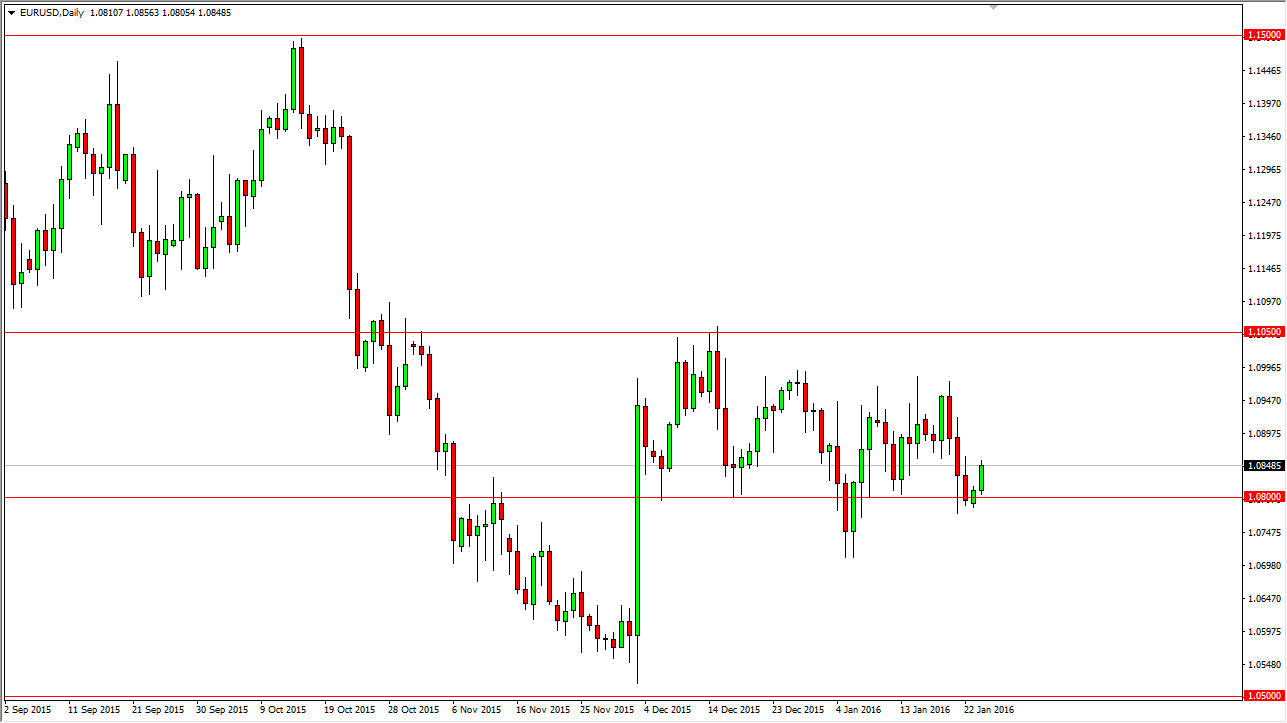

EUR/USD

The EUR/USD pair rallied during the course of the session on Monday as the 1.08 level continues to offer support. Given enough time, the market looks as if it will try to reach the top of the recent consolidation area that we’ve seen over the last several weeks. Because of this, I think that the buyers will more than likely try to push this currency pair higher over the next session or so.

I also believe that the sellers will return somewhere near the 1.0950 level, and because of this I feel that it is only a matter of time before both sides of the trade get what they want. I have no real interest in trying to hang onto a longer-term trade, but in at this point in time I have to favor the upside for at least the next 100 pips.

GBP/USD

The GBP/USD pair broke down during the course of the day on Monday, but still sees quite a bit of support just below. Ultimately though, I feel that the 1.43 level is the real barrier that the market is respecting, so given enough time I think the sellers will return on any short-term rally. With this, I am a seller of this market and have no interest whatsoever in buying as the area seems to be far too resistive, and of course we have a longer-term trend which is so well ensconced at this point in time.

The US dollar continues to be the favored currency by Forex traders around the world at the moment, and I don’t think that’s going to change anytime soon. I believe that this market will trying to reach down towards the 1.40 level again, and right now that is my target but I also recognize there will probably be quite a bit of volatility between now and then.

Leave A Comment