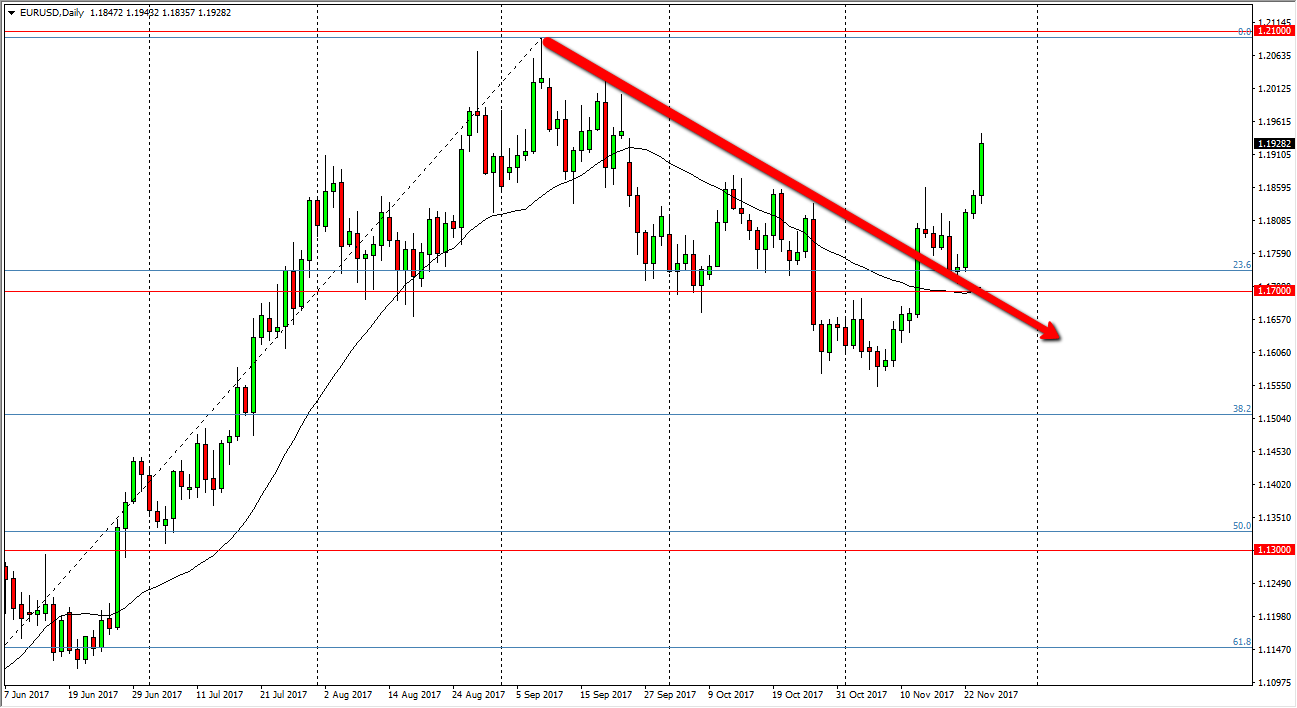

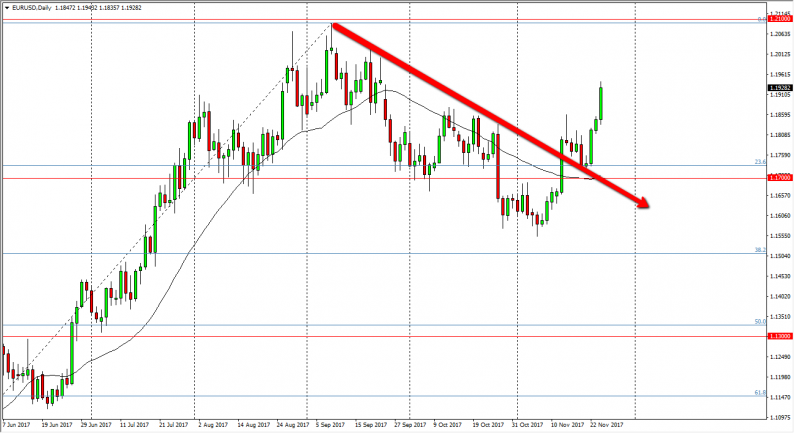

EUR/USD

The EUR/USD pair rallied again on Friday, breaking above the 1.19 level. We now look as if we are ready to go looking towards the 1.21 handle again, which was the recent highs. Pullbacks should be buying opportunities, and I believe that the US dollar continues to get pummeled based upon the U.S. Congress not being able to pass tax reform. Pullbacks of this point should find plenty of support at the 1.18 level, and most certainly the 1.17 level underneath. The market looks very likely to be volatile, but I think we are going to continue to see overall bullish attitude in this market, so I continue to buy the dips and add as we go further. A break above the 1.21 level has this market looking for much higher levels, with the 1.25 level being a nice target above.

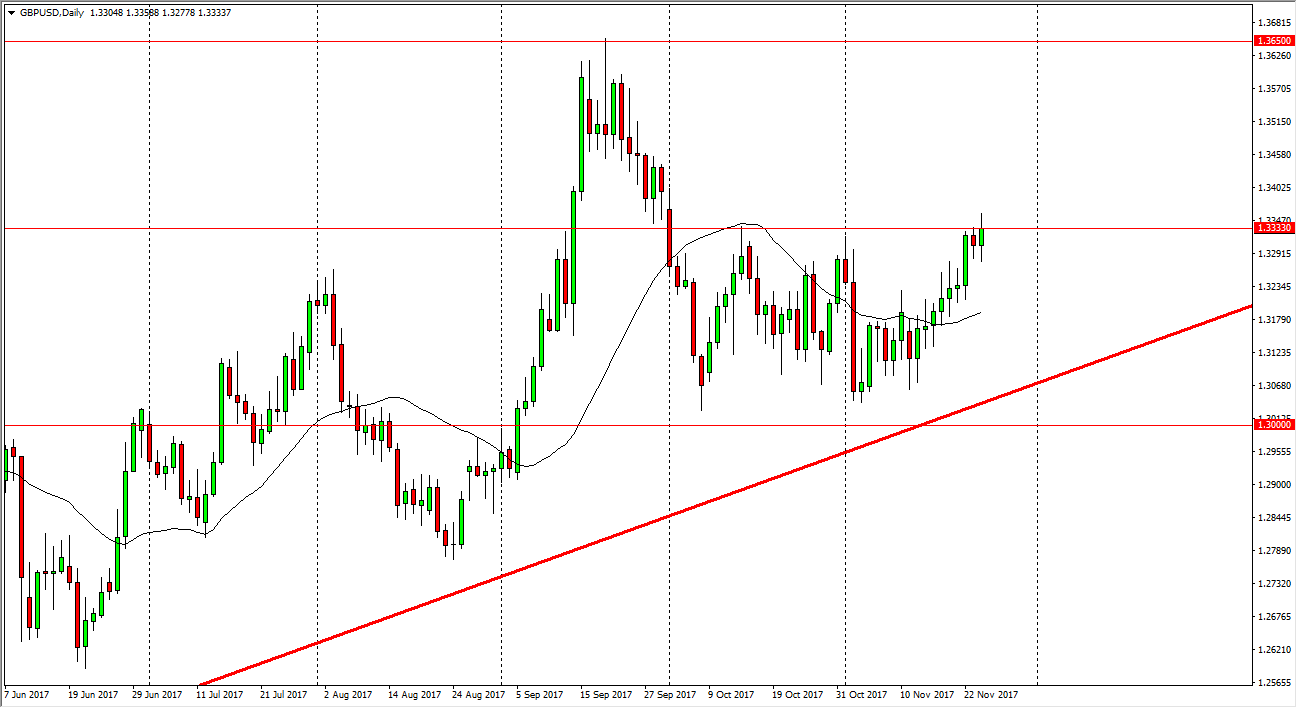

GBP/USD

The British pound had a bullish session during the day on Friday as well, and at one point broke above the 1.3333 level. If we can break above the top of the range for the day on Friday, I believe that the British pound continues to go much higher, at first looking for the 1.35 handle, and then eventually the 1.3650 level. Volatility should continue, but if we do pull back from here, I think that we will find plenty of support near the 1.32 level, and most certainly at the uptrend line just below there. In general, I believe that the British pound is trying to break out to the upside, and the U.S. Congress is doing what it can to devalue the US dollar by inactivity. Longer-term, I believe that we will eventually go looking towards the 1.3650 level above, and perhaps even break above there for a longer-term buy-and-hold situation.

Leave A Comment