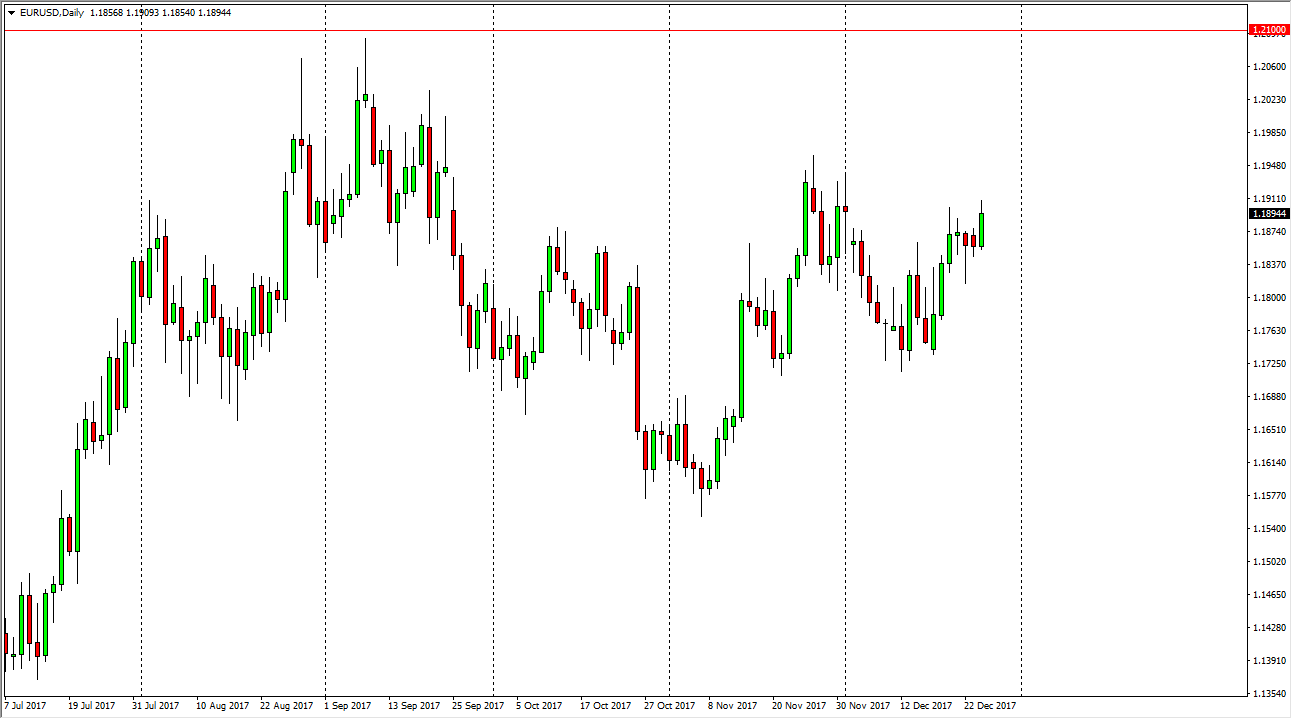

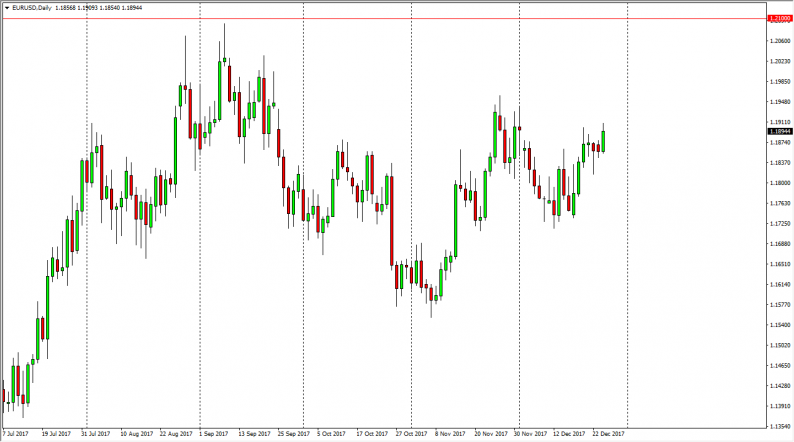

EUR/USD

The euro rallied again during the trading session on Wednesday, breaking towards the 1.19 level. We did pull back a little bit during the trading session though, and as we continue to see a lot of volatility, I think that the market is trying to build up enough momentum to finally break out to the upside. Once we do, a clearance of the 1.21 level could signify a “buy-and-hold” marketplace, which I think is something that we are going to see in 2018. That’s not to say that this will be an easy move, and never is in the currency markets, and of course this is the domain of high-frequency trading. Pullbacks should be buying opportunities, and I believe that the 1.17 level underneath is going to offer massive support. If we were to break down below there, we would almost certainly fall to the 1.15 level, albeit very unlikely to happen.

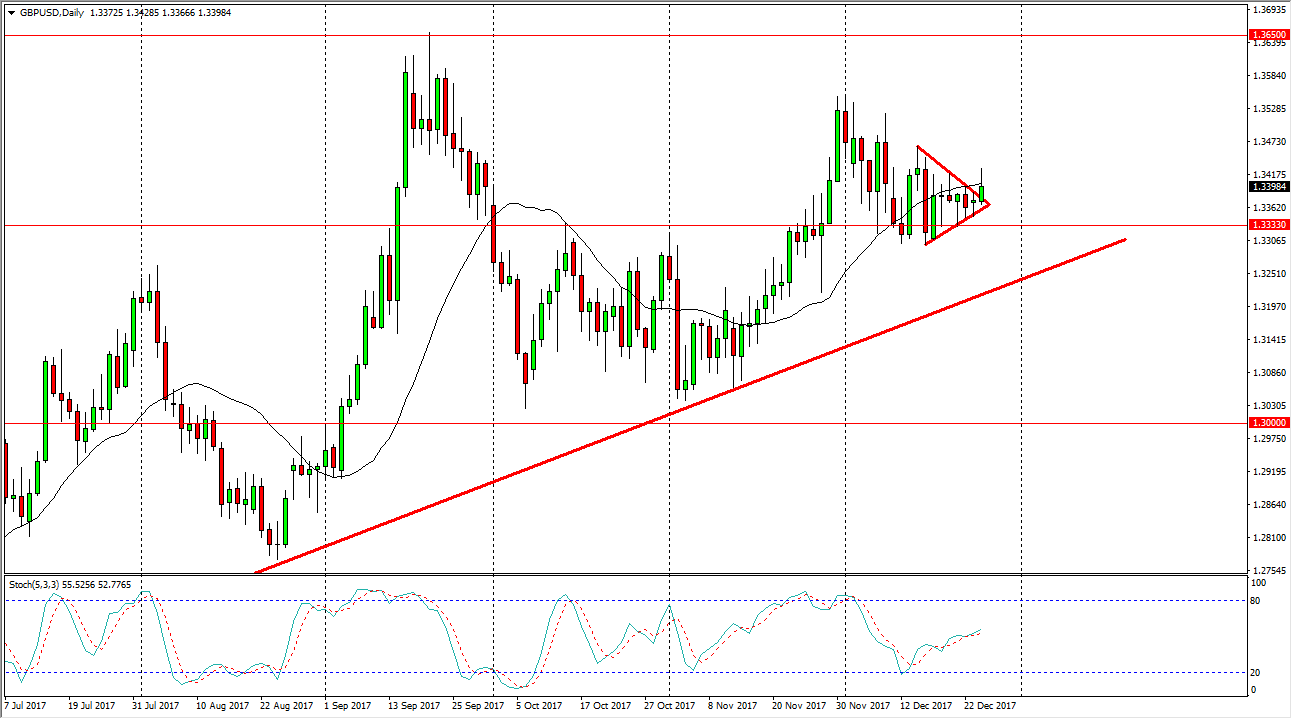

GBP/USD

The British pound broke out of the symmetrical triangle during the trading session, but on low-volume. Because of this I don’t read too much into the move, other than it is a continuation of the buying pressure that we have seen just below. I think that the 1.3333 level continues to offer significant support, and we are trying to break out to the upside. The 1.35 level above will be targeted, followed closely by the 1.3650 level. A break above there is a “buy-and-hold” market just waiting to happen, and I think that happens after New Year’s Day.

I see a strong uptrend line just below, so I have no interest in shorting this market as I think it will continue to offer a significant amount of value going forward. Longer-term, I fully anticipate that the British pound will gain quite handily over the year.

Leave A Comment