Yellen went full dovish, once again, and this certainly hurt the US dollar. What does this mean for EUR/USD? The team at Nordea analyzes:

Here is their view, courtesy of eFXnews:

The Fed has done its best to propagate confusion recently. Why the Fed chose to walk the dovish path in March is crucial for the medium-term outlook for the currency

If the Fed’s move does reflect a policy shift reflecting a readiness of “falling behind the inflation curve”, then the USD could see further setbacks in the months and quarters to come before a comeback down the road. The Fed Troika’s comments on this must be watched closely (Dudley, Fischer, Yellen).

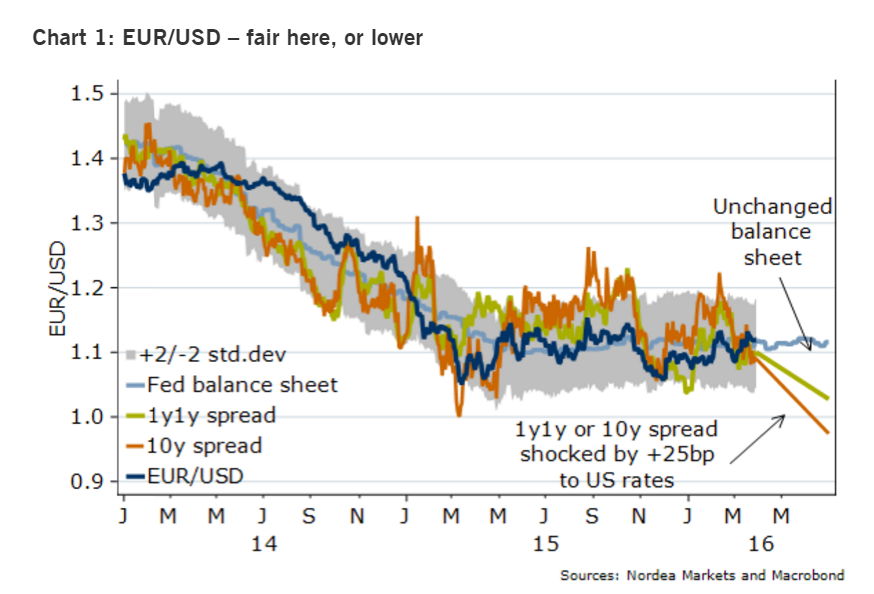

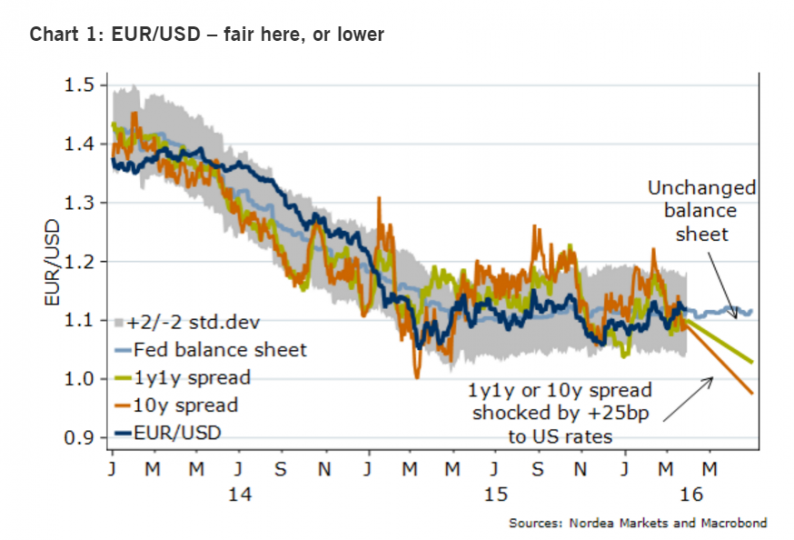

On the other hand, if the Fed’s move merely reflects other policy considerations, then it should be business as usual. A model-approach based on 1y1y or 10y spreads suggest EUR/USD should trade around current levels, or head lower (assuming a +25bp shock to US rates but EMU rates unchanged).

While it is hard to see EMU rates drop by 25bp, with 1y1y Eonia already at ~-40bp and the German 10y yield at 17bp, it could be that long bond yields in Europe may face some further downside pressure when the ECB operationalises its QE expansion starting April 1.

As for the US, much attention will be spent on the trajectory of inflation. The Fed is currently predicting a slowdown in core PCE inflation from todays (according to the Fed artificially high) levels while the consensus is looking for somewhat higher numbers.

Indeed, the Fed predicts core PCE inflation at 0.11% per month between today and December 2016 while the average core PCE increase over the past five years is higher (0.135%). In fact, the consensus also predicts below-average inflation at 0.13%/month. If the consensus is correct, a Fed turning more hawkish seems a likely response.

While GDP growth is less important than inflation, all bad news from the strong currency on US manufacturing sentiment is priced in by now. The US manufacturing sector will outperform the Euro Area in 2016 (in terms of manufacturing sentiment).This should mitigate US growth fears further, and be a USD-positive as it will pave the way for further improvements in the labour market (which is normally seen as *the* inflation driver).

Leave A Comment