EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be made before 5pm London time today.

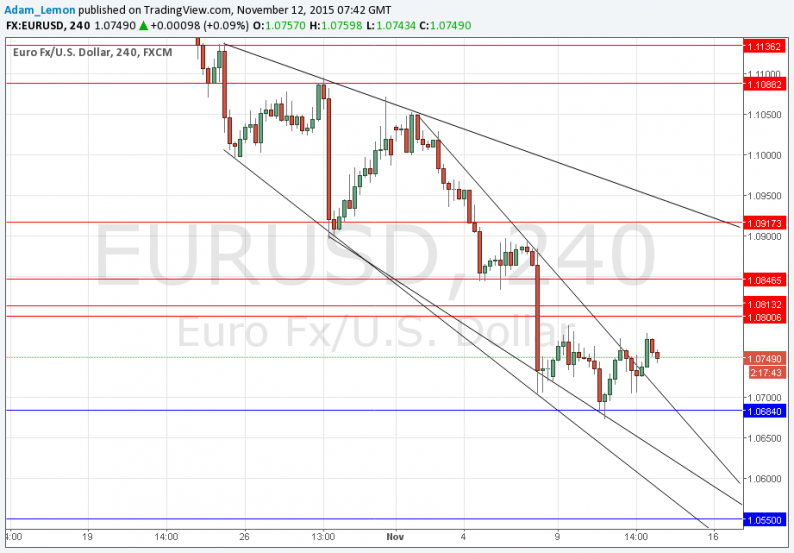

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0684.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.0800 and 1.0813.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0846.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

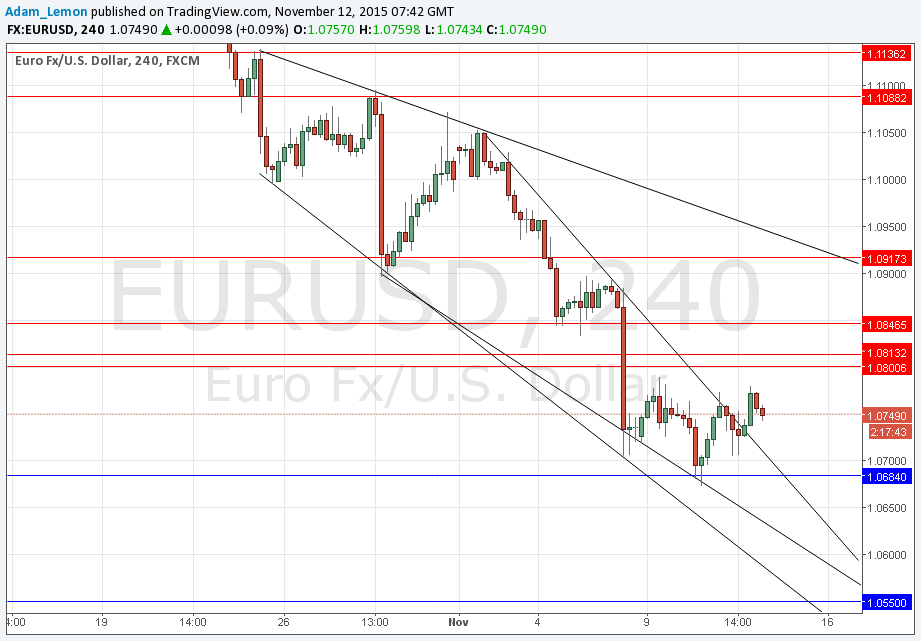

EUR/USD Analysis

The price broken up above the bearish inner trend line but could not break 1.0775, forming a triple top there. Although over the past 24 hours the price really went nowhere, overall I have to say this pair looks like it is going to go down if it is going to go anywhere. There will probably be no real direction until the US economic news release arrives later today shortly after New York opens.

Regarding the EUR, the President of the ECB will be speaking at the European Parliament at 8:30am London time. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm, followed at 2:30pm by the Chair of the Federal Reserve speaking at a conference.

Leave A Comment