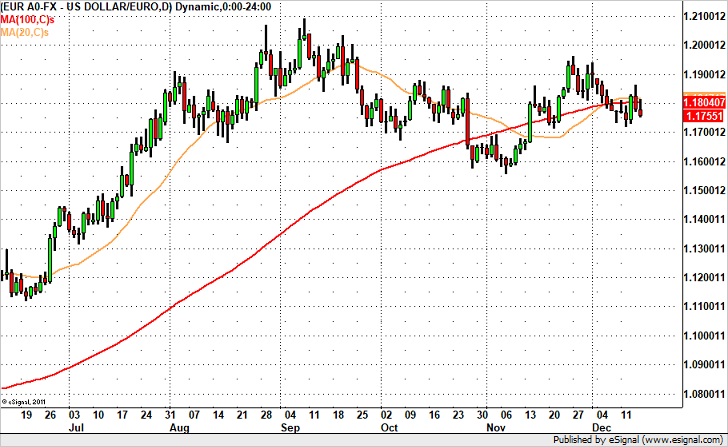

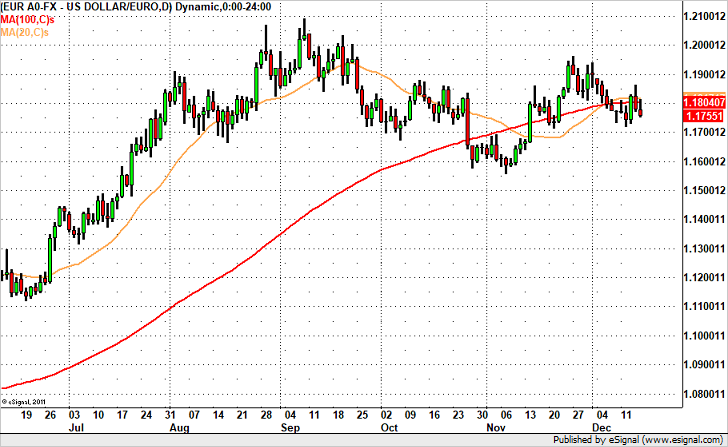

Despite stronger economic data and upgraded economic projections, the euro failed to extend higher after breaking out of Wednesday. The latest reports show service and manufacturing activity accelerating, leading to greater investor confidence. Next week’s German IFO report is expected to reinforce the improvement, giving euro a fresh catalyst to trade higher. Unfortunately on a technical basis the currency looks weak and poised for a retest of 1.1700. Fundamentally, the economy is strong — the ECB left interest rates unchanged and substantially upgraded their growth forecasts. They now see the economy expanding by 2.4% this year up from 2.2% and raised their 2018 GDP forecast to 2.3% from 1.8%. Their inflation forecasts were left unchanged. Although the euro did not respond to these changes and Mario Draghi’s optimistic comments about the economy’s momentum due to his concerns about low inflation, we still think EUR/USD losses will be limited. The central bank’s plans to keep rates steady until QE ends is not new and between now and then if inflation rises, they could adjust their views.

On a technical basis, the rejection of the 20 and 200-day SMA puts EUR/USD on track for a move to and possible below 1.17.

Leave A Comment