The advance 4Q U.S. Gross Domestic Product (GDP) report may generate headwinds for the greenback as the update is expected to show a small slowdown in the growth rate.

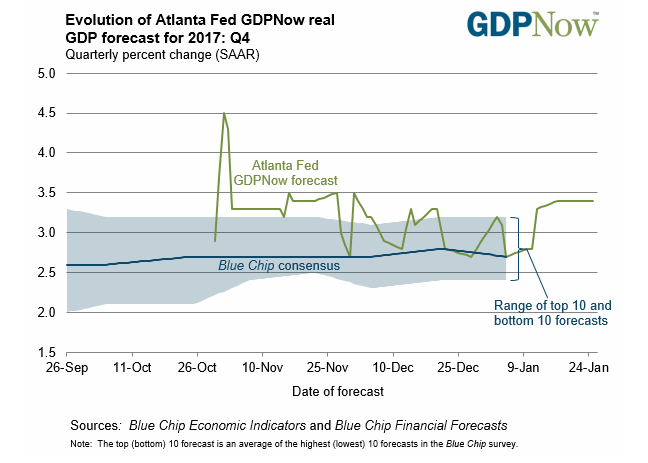

Keep in mind, the Atlanta Fed’s GDPNow model still forecasts a 3.4% rate of growth even as ‘the forecast of fourth-quarter real residential investment growth decreased from 10.2 percent to 9.5 percent after yesterday’s existing-home sales release from the National Association of Realtors and this morning’s housing market releases from the U.S. Census Bureau, and another batch of below-forecast prints may produce bearish reaction in the greenback is dampens bets for an imminent Fed rate-hike.

Nevertheless, market participants may pay close attention to the core Personal Consumption Expenditure (PCE) as the Fed’s preferred gauge for inflation is projected to increase an annualized 1.9%, and indications of stronger price growth may curb the near-term advance in EUR/USD as encourages the Federal Open Market Committee (FOMC) to normalize monetary policy sooner rather than later. New to trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Impact that the U.S. GDP report has had on EUR/USD during the previous quarter

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post event )

Pips Change

(End of Day post event)

3Q A

2017

10/27/2017 12:30:00 GMT

2.6%

3.0%

-15

-2

3Q 2017 U.S. Gross Domestic Product (GDP)

EUR/USD 15-Minute Chart

The U.S. economy grew an annualized 3.0% during the three-months through September, with Personal Consumption increasing 2.4% during the same period amid forecasts for 2.1% print. At the same time, the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, climbed to an annualized 1.3% from 0.9% in the second-quarter, and signs of budding price pressures may encourage the Federal Open Market Committee (FOMC) to further normalize monetary policy over the coming months as the economy approaches full-employment.

Leave A Comment