EUR/USD is certainly already on the move, thanks to the big dollar dive. To be fair, this assessment from Danske was released before the move. Here is their reasoning:

Here is their view, courtesy of eFXnews:

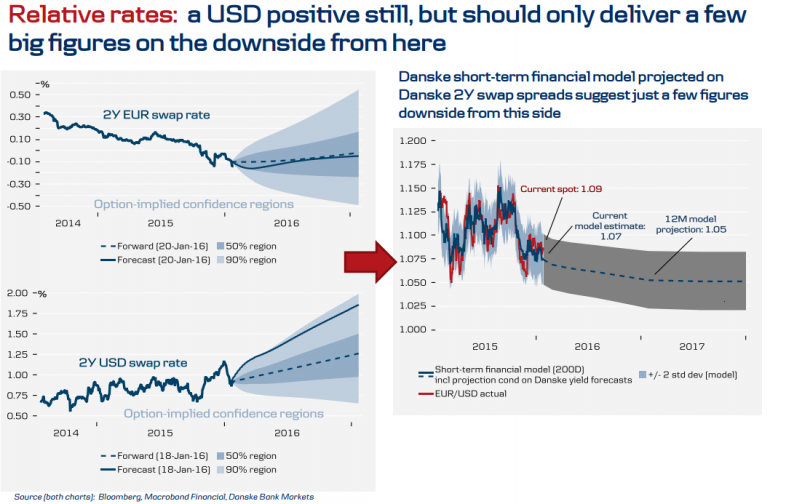

One argument for a lower EUR/USD:

– Relative rates: still in favour of USD…

…but several arguments for a higher EUR/USD:

Valuation: EUR/USD is substantially undervalued

External balances: The EU/US CA differential is at its widest level since 2004-06

Cyclicals: the Eurozone’s business cycle looks stronger than the US cycle

Positioning: speculators are stretched short EUR/USD > impact of relative rates fading

Terms of trade: ’lower oil for longer’ has become a EUR positive

Hedging flows: commercials FX hedging of EUR set to fall, which should support EUR/USD

Now is the time to prepare for a higher EUR/USD: We recommend investors have long EUR exposure. We recommended to buy EUR/USD 12M bullish seagull.

Leave A Comment