US stock market valuations are high and, depending on the specific measure you look at, one can either argue that we are modestly overvalued or in a straight up bubble in just about everything. Those arguing stocks are modestly overvalued believe we can move higher. Those arguing for a bubble, usually believe a crash or crisis is upon us.

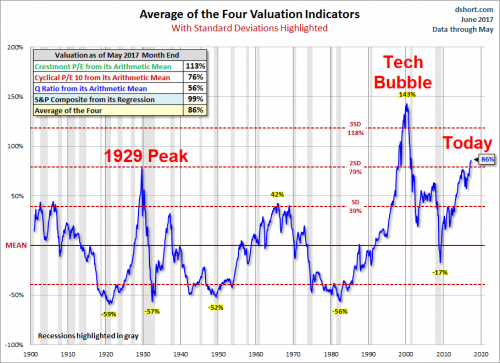

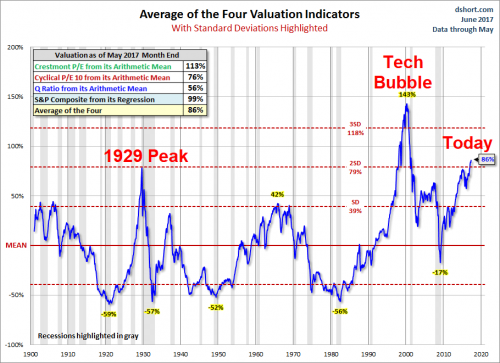

One measure we cite the most on our podcast is the average of four valuation indicators from Doug Short and it shows that the S&P 500 is currently the second most expensive on record, trailing only the tech bubble (see below).

Source: Doug Short

As Ed Easterling at Crestmont Research recently explained on our program, current market valuations mean that we are likely to see below-average returns over the next ten years, but that doesn’t tell us what to expect over the short-term.

Additionally, there’s a decent argument to be made that “this time (really) is different” when making comparisons of where valuations have fluctuated in the past compared to where they are today.

Consider Michael Pettis on Capital Flows and Debt Crises:

“Is there anything different this time around? It turns out that there is. This is the first time we’ve had one of these huge globalization cycles in a period in which you had credible fiat money.

Under the gold standard days (pre-1971), there was a limit as to how much you could allow domestic debt and domestic money supply to expand, and that depended on the gold ratio and levels of confidence, etc., but there was a more or less a hard-limit. Nowadays, because of credible fiat currency, we don’t know where that limit is…

Now that’s both good and bad. It’s bad in the sense that once you reach that limit you get a financial crisis and you collapse, but what happens if there’s something that prevents you from reaching that limit? If you can keep expanding the money supply and you can keep expanding debt, what happens in a case like that? Well, I think we know and we call it that really ugly word, ‘Japanification’.

That’s what I’m worried about because we don’t ever have to have a crisis as long as we have the ability to increase debt and increase the money supply in a credible way. But do we really want that? We won’t have those ugly crises but, remember, at its peak, which was not so long ago, Japan was something like 16-17% of the world and today it’s 6% of the world. That’s much worse than has ever occurred in the form of a crisis.”

Leave A Comment