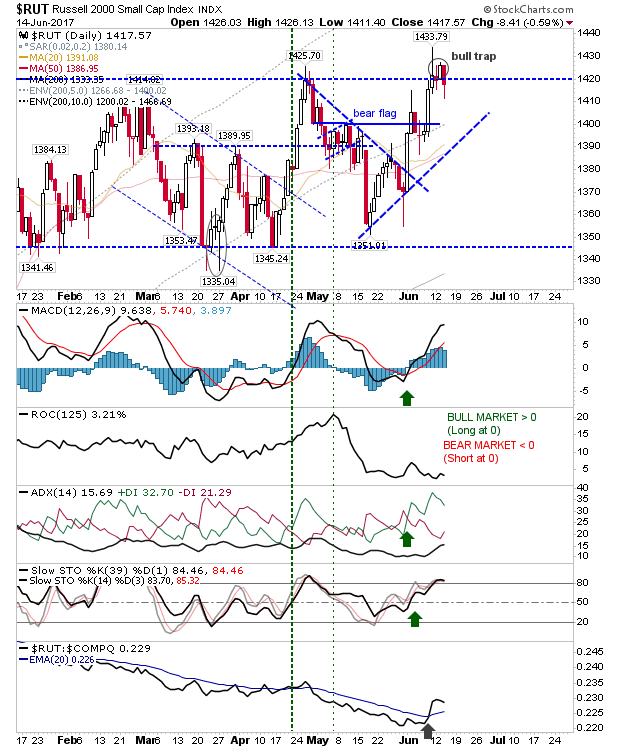

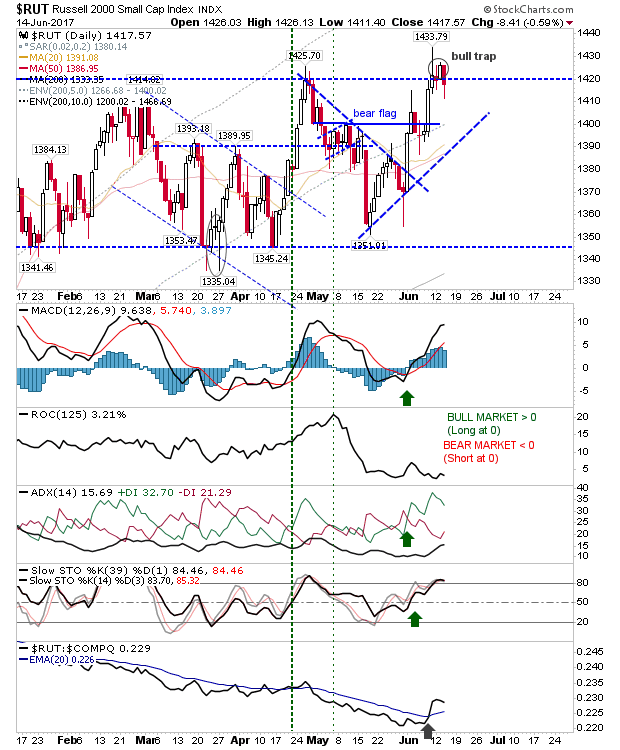

Markets experienced another round of profit taking but there was only one market showing a potential top. Yesterday, the Russell 2000 edged a breakout but today sellers put this in jeopardy with a potential ‘bull trap’.

The ‘bull trap’ in the Russell 2000 will be negated on a move above 1,433. Further losses will drop the index back inside the prior consolidation, but ‘bull traps’ often lead to moves to the other side of the consolidation – in this case, a break below 1,340.

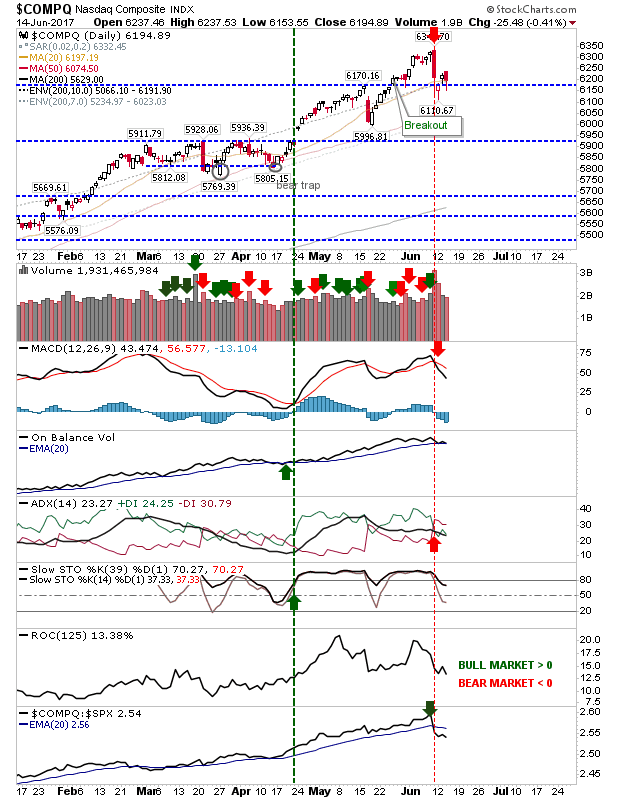

The Nasdaq offers a shorting opportunity as the index struggles to make back last Friday’s loss. The 20-day MA is playing as resistance; place stops a few percentage points above the MA.

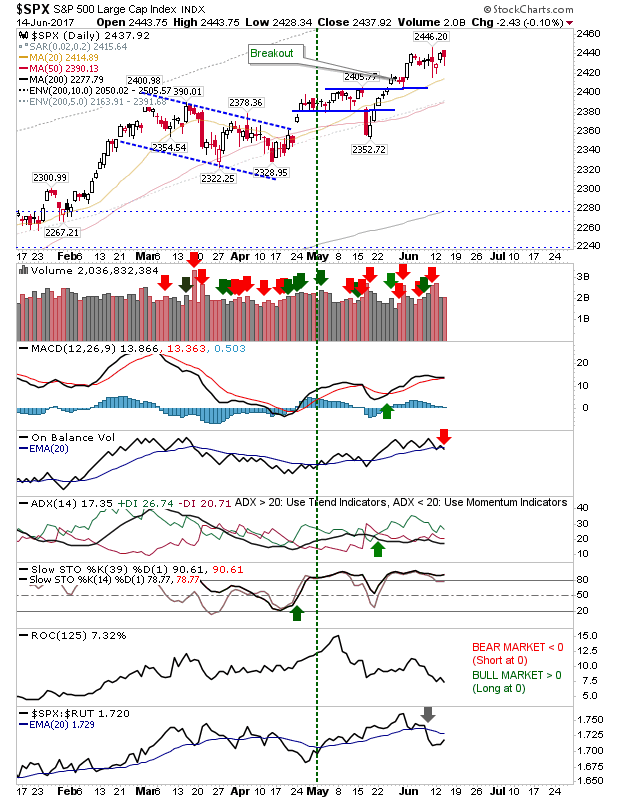

The S&P is more likely to shape a consolidation as other indices distract attention. Selling volume was light, but there was a ‘sell’ trigger in On-Balance-Volume. There is no clear topping behaviour for this index, so it’s a wait-and-see for now.

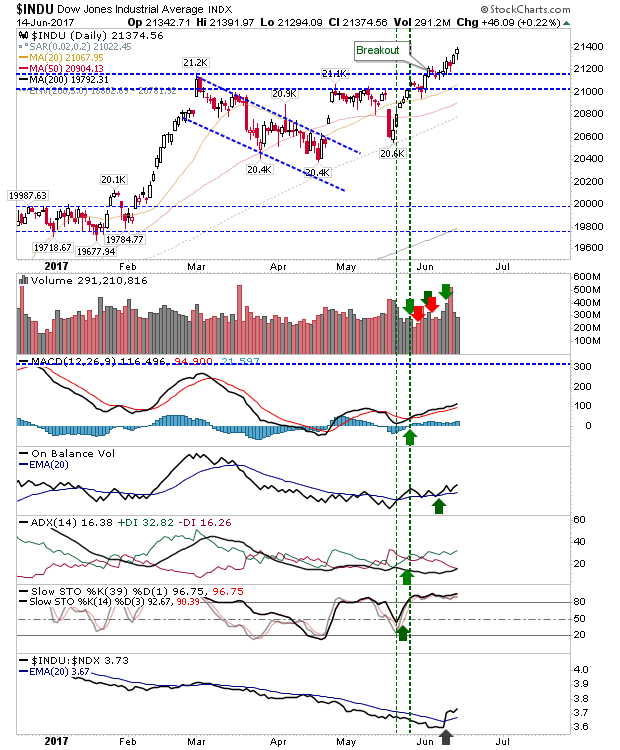

In contrast, the Dow Jones Industrial average added to prior gains. Momentum buyers will be pleased with its behavior.

For tomorrow, track action in the Russell 2000 and Nasdaq. If sellers add to today’s action then this could start a wave of profit taking and new shorting opportunities.

Leave A Comment