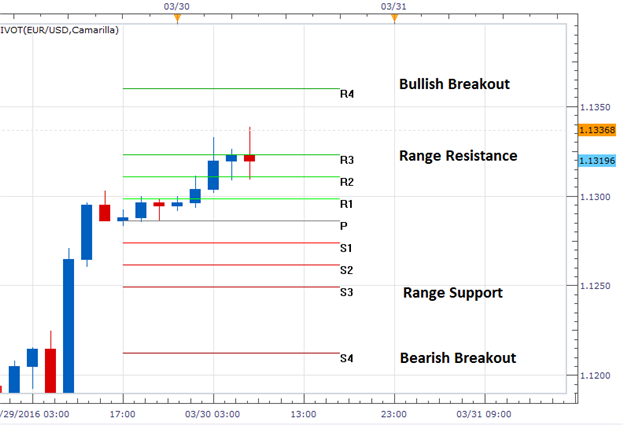

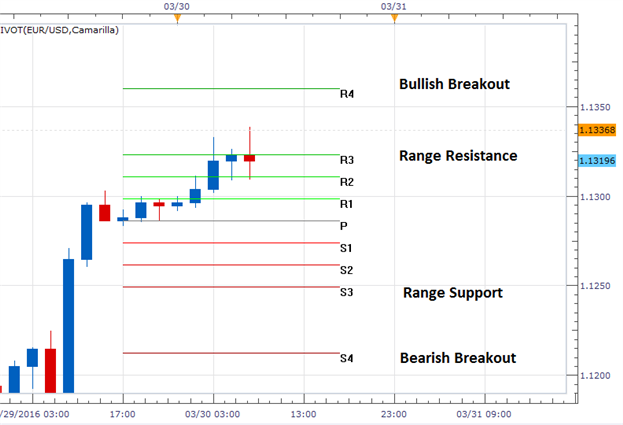

EUR/USD 2 Hour Chart

(Created using Marketscope 2.0 Charts)

The EUR/USD is testing resistance this morning, but has failed to breakout despite a series of high importance news events. This morning EUR German CPI (YoY) figures were released at .3%. This was better than the expected value of .1%. Even with this news, the EUR/USD is still trading under today’s R3 Camarilla pivot at 1.1323. It should be noted that the EUR/USD has broken out to new highs in its previous two trading sessions. If the pair attempts to move higher, traders may look for bullish breakouts above the R4 pivot at 1.1360. In this scenario, traders may use today’s 111 pip range to extrapolate initial targets near 1.1471.

In the event that the EUR/USD fails to break higher, it opens the pair up to retrace towards values of support. Today’s value of range support is found at the S3 pivot at a price of 1.1249. As well, bearish breakouts may begin below the S4 pivot point at 1.1212. A move to this value would be considered significant as it would be the first attempted bearish breakout in the last four trading days.

SSI (Speculative Sentiment Index) currently reads at -1.70 for the EUR/USD. When taken as a contrarian signal, this negative number suggests that the EUR/USD may be preparing for a future advance. Going into this weeks close, traders should monitor SSI to see if it reaches -2.0 or lower. A move to a negative extreme may be used to add validation to any fresh bullish breakouts. Conversely, traders looking for a bearish reversal should look for a flip in SSI to a positive value. A move of this nature may suggest a move towards more bearish market conditions.

Leave A Comment