Previous:

On Monday the 12th of March, trading on the EUR/USD pair closed slightly up. There were price fluctuations in both directions. During the European session, the euro bulls hit a high of 1.2340, after which the euro slumped to 1.2290. In terms of the intraday dynamics, these movements were similar to Friday’s.

The euro recovered all of its losses during trading in the US and hit a new session high on the back of a falling US dollar and declining bond yields. US10Y bond yields dropped from 2.9135 to 2.8626. There weren’t many developments yesterday, so these movements were largely expected.

Day’s news (GMT+3):

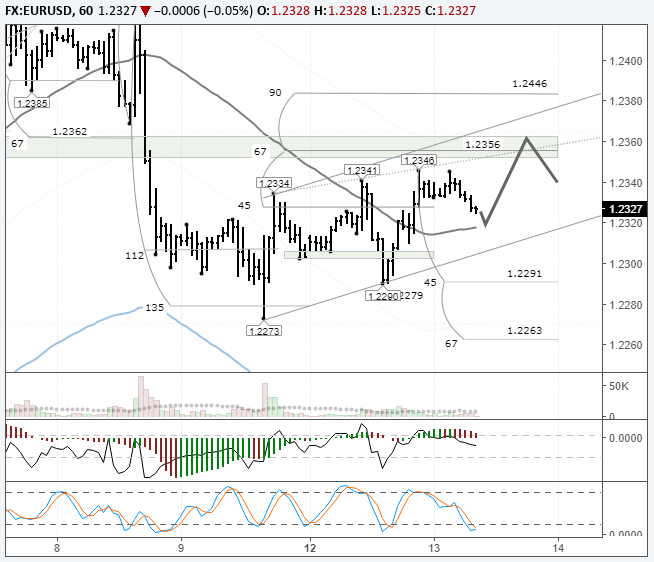

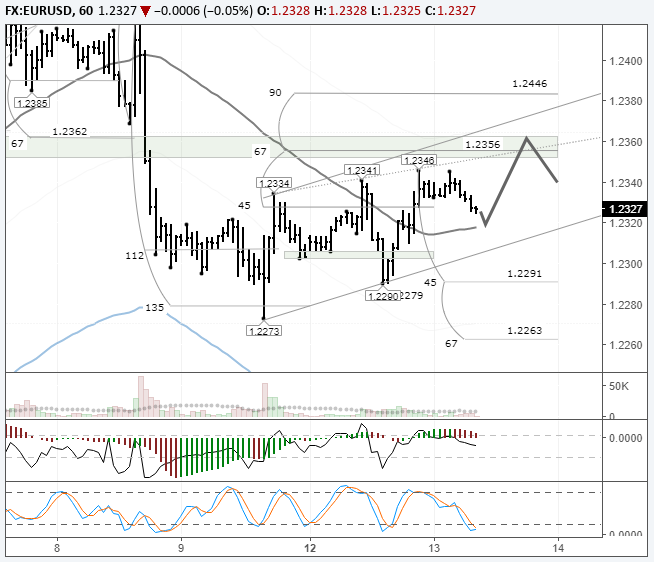

Fig 1. EURUSD hourly chart. Source: TradingView

We’ve got two similar intraday formations that have created two bases. The right base is shifted upwards. This leads me to predict a rise for the euro to around 1.2362 since the range of 1.2273 – 1.2390 is now a strong support. The cycles on the hourly timeframe are also looking up.

At the time of writing, the euro is trading at 1.2326 (-0.06%). The dollar is currently trading up against most of the majors. The euro crosses, on the other hand, paint a mixed picture.

This Tuesday, investor attention will be turned towards US CPI data. This is an important indicator for the Federal Reserve since they are expected to raise interest rates by 0.25% next week.

Leave A Comment