The euro’s surge to an almost two-year high put a cap on the global market rally in Friday’s quiet session, with most major exchanges consolidating after a second strong week of gains. The MSCI Asia-Pacific index declined for first time in ten days while the European Stoxx 600 index was fractionally in the green as were US equity futures ahead of earnings reports from General Electric, Honeywell, Schlumberger and others. Oil gained with Brent flirting with $50, zinc rallied along with most base metals. European stocks are little changed, while Asian stocks decline with Tokyo shares falling for first time in three days.

Also overnight, AUD traders were caught wrongfooted for the second time in one week after the Aussie fell sharply following an unexpectedly dovish speech from RBA Deputy Governor Debelle, who said there’s no significance in the board’s neutral rate discussion, which earlier this week sent the Aussie surging. “No significance should be read into the fact the neutral rate was discussed at this particular meeting,” Debelle said in text of speech. “Most meetings, the board allocates some time to discussing a policy-relevant issue in more detail, and on this occasion it was the neutral rate.” In addition to the drop in AUDUSD, Australian sovereign yields all dropped 5-7 basis points in bull steepening move; three-year yield drops as much as nine basis points to 2.00% – the steepest decline since March on a closing basis. Kiwi rallied to highest since September 2016 on Finance Minister Joyce comments; yen little changed. S&P futures near unchanged. WTI crude holds near $47; Dalian iron ore falls 0.7%.

But most of the attention was on the EUR in the aftermath of Thursday’s paradoxical Draghi press conference, which led to a “bipolar” market reaction, seen as dovish by rates while hawkish by FX.

Summarizing the market reaction, Yann Quelenn, a market strategist at Swissquote Bank said,“Draghi tried to talk the Euro down, even going so far as to suggest that ECB’s quantitative easing could be increased and prolonged. But the currency markets were not buying Draghi’s line, and neither are we. Available bonds are too scarce, and turn to a taper is too clear to disguise.”

As a result, bonds jumped even as the euro headed for its strongest level against the dollar in almost two years on bets the European Central Bank will start tapering its stimulus program despite Draghi’s sounding particularly dovish, with the greenback already under pressure from U.S. political developments. Yields on Italian bonds dropped…

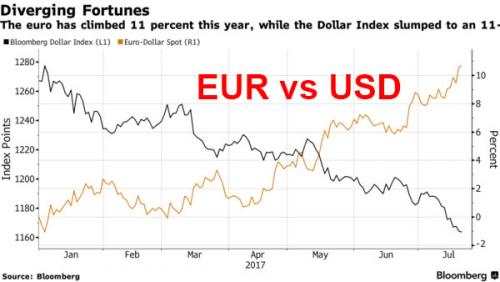

… while the EUR surged to the highest since August of 2015, and is up 11% for 2017…

… while the US dollar dropped to the lowest since August amid growing political concerns after reports that U.S. special counsel Robert Mueller expanded his investigation of Trump less than a day after the president told the New York Times that any digging into his finances would cross a red line.

“Everything speaks in favor of further EUR appreciation — increasing portfolio inflows, changing monetary policy, improved political risks,” according to Peter Kinsella, a London-based senior foreign-exchange and rates strategist at Commonwealth Bank of Australia. “It’s an armor-plated rally and it won’t stop”

Euro zone stock markets were modestly lower on the day, as some analysts against expressing concerns a stronger euro may do more to undermine growth going forward.

MSCI’s gauge of stocks across the globe was steady after rising for a 10th straight session on Thursday, its longest such streak since February 2015. It has advanced around 3 percent in the latest rally. In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan, which has gained about 5 percent in the past two weeks, eased 0.2 percent, dragged down by a fall in material and financial shares. Japan’s Nikkei dropped 0.2 percent.

“We can be pretty sure that when Draghi sat down for his press conference yesterday the last thing he expected to see was the euro hit its highest level in over two years and for equity markets to slide back,” said CMC Markets analyst Michael Hewson. “The strength of the euro does appear to be acting as a bit of a headwind for European stocks as they look to close the week sharply lower, in contrast to the performance of UK and US stocks this week.”

As of 6:10am ET, S&P500 futures were little-changed close to a record-high level as investors looked forward to a Federal Reserve meeting and manufacturing data next week.E-mini contracts were almost flat at 2,472.25 after the cash index ended Thursday within one point of its record-high close. Nasdaq 100 futures were also little-changed as the benchmark index climbed to all-time intraday highs for the second consecutive day. Contracts on the Dow Jones Industrial Average also held steady on Friday.European stocks are little changed, while Asian stocks decline with Tokyo shares falling for first time in three days.

In currencies, the Bloomberg Dollar Index was down 0.1 percent, in line for a weekly loss of 0.8 percent, at 10:41 a.m. in London, as the greenback weakened against most of its G-10 peers. The yen was up 0.2 percent at 111.71 per dollar. The euro climbed 0.1 percent to $1.1642 after reaching a 23-month high earlier in the session. The common currency has gained 1.6 percent this week, its second straight five-day advance.

Leave A Comment