The mainstream world of economics and investment has the attention span of a 12-year-old hopped up on sugar.

A couple of months ago, it was all doom and gloom for gold. The Fed was talking interest rate hikes, government spokespersons were claiming victory over the recession, and mainstream analysts were hastily pounding nails in gold’s coffin.

Cancel the wake, because today everybody has turned bullish on gold with the price up more than 9% since New Year’s Day.

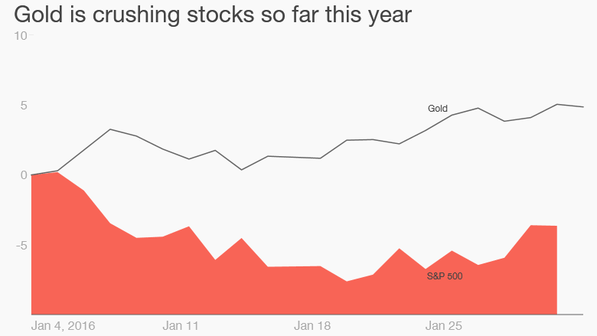

A headline at CNN Money earlier this week boldly proclaimed, “Gold is 2016’s most beloved asset.” The story highlights the more than 10% gain in the price of gold since its low after the Fed hiked rates in mid-December, along with the dismal performance of stock markets, pointing out the Dow is down more than 1,000 points and the NASDAQ has lost 8% of its value:

These opposite moves actually make perfect sense. Gold tends to shine brightest during times of stress. The precious metal is viewed as a reliable store of value for investors to turn to when they’re worried about economic doom. And right now, there’s no shortage of exactly that kind of anxiety.”

Time Magazine published a similar article this week and drew the same conclusion. It seems the mainstream suddenly woke up and swerved into reality. At least for the moment, Gold is in vogue.

But the signs have been there all along. These people just weren’t paying attention.

For months leading up to the Federal Reserve rate hike, Peter Schiff was saying the economy wasn’t strong and the data didn’t justify such a move. From the day the Fed nudged up the rate until now, Peter has said it wasn’t the beginning of rising interest rates, but the end. He’s consistently stayed on message, despite the naysayers:

The Fed is not going to be able to continue with rate hikes. It’s going to have to reverse course. It’s going to have to go back to zero, maybe negative. It’s going to launch QE4, and that’s going to be a game changer for the currency markets and the commodity markets…”

Leave A Comment