Companies and investors have some big decisions ahead of them as we start the second half of the year. They can be summed up in one super-critical question:

“Do they believe that global reflation is finally now underway?”

The arguments in favour of this analysis were given last week by European Central Bank President, Mario Draghi:

“For many years after the financial crisis, economic performance was lacklustre across advanced economies. Now, the global recovery is firming and broadening…monetary policy is working to build up reflationary pressures…we can be confident that our policy is working and its full effects on inflation will gradually materialise.”

The analysis has been supported by other central bankers. The US Federal Reserve has raised interest rates 3 times since December, whilst the Bank of England has sent the pound soaring with a hint that it might soon start to raise interest rates. Most importantly, Fed Chair Janet Yellen told a London conference last week that she:

“Did not expect to see another financial crisis in our lifetime”.

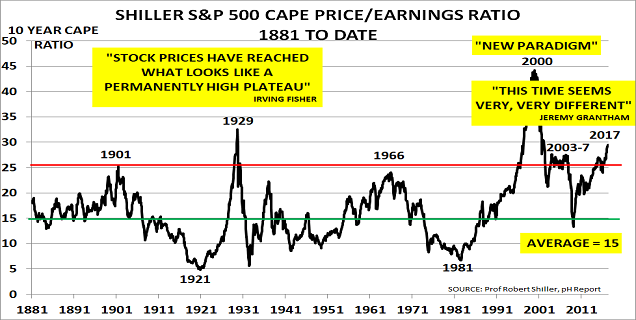

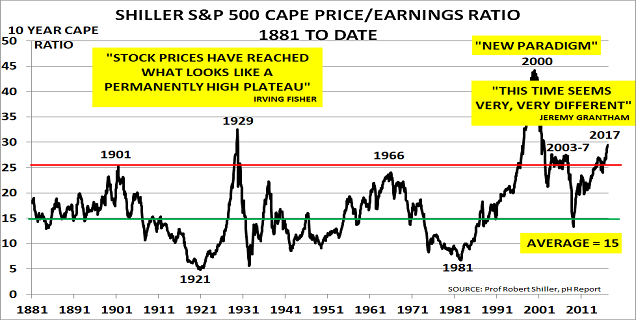

The chart above from Nobel Prizewinner Prof Robert Shiller confirms that investors certainly believe the reflation story. His 10-year CAPE Index (Cyclically Adjusted Price/Earnings Index) has now reached 30—a level which has only been seen twice before in history – in 1929 and 2000. Neither were good years for investors.

Even more striking is the fact that veteran value-investor, Jeremy Grantham, now believes that investors will have “A longer wait than any value manager would like, including me” before the US market reverts to more normal valuation metrics. Instead, he argues that “this time seems very, very different” – echoing respected economist Irving Fisher in 1929 who suggested “stock prices have reached what looks like a permanently high plateau“.

Leave A Comment