Dow crashed over 1000 points today…

Time for “Markets In Turmoil” special

Markets “turmoiled” again today as Treasury yields spiked on a weak auction and the implications of a budget deal that means more supply is coming. This spooked stocks once again and XIV, the Inverse ETF, tumbled at the open – after ramping stocks delusionally into the open. As stocks got monkey-hammered again, so bonds were bid and ended with a relatively small rise in rates as plunges in Risk-Parity funds likely prompted forced delevering in stocks and bonds. Perhaps most notably, credit spreads started to snap wider and rate volatility spiked as equity market contagion spreads.

Video length: 00:00:08

Investors have swung from “extreme greed” to extreme fear” in a record few days…

Source: CNN Money

While the mainstream media attempts to calm investors that this is a “healthy pullback,” one of their pillars of support just snapped. HY credit spreads snapped wider to 10-month wides and even IG spreads spiked…

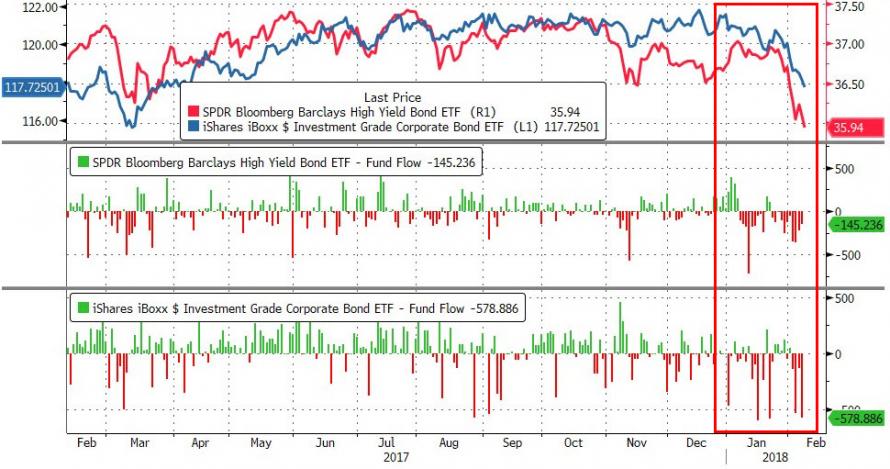

This should not be a surprise as HY and IG ETFs have seen major outflows…

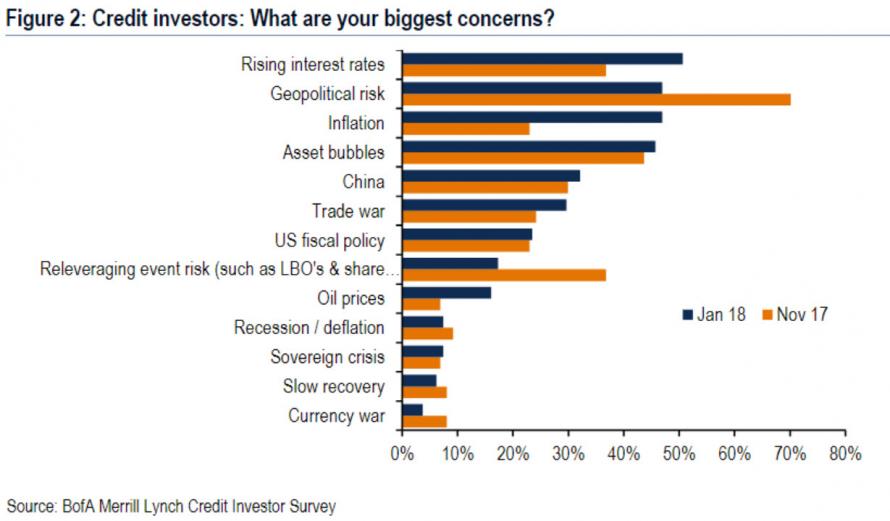

As credit investors fear rising rates more than anything else…

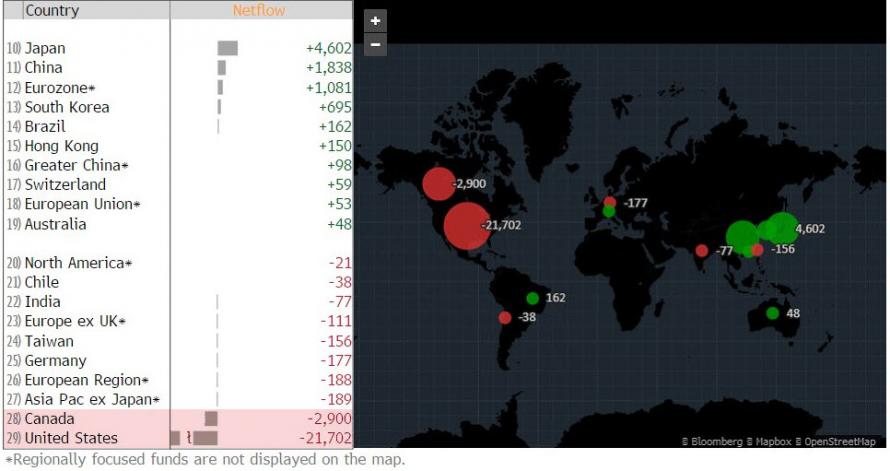

And the last week has seen huge equity outflows from US ETFs…

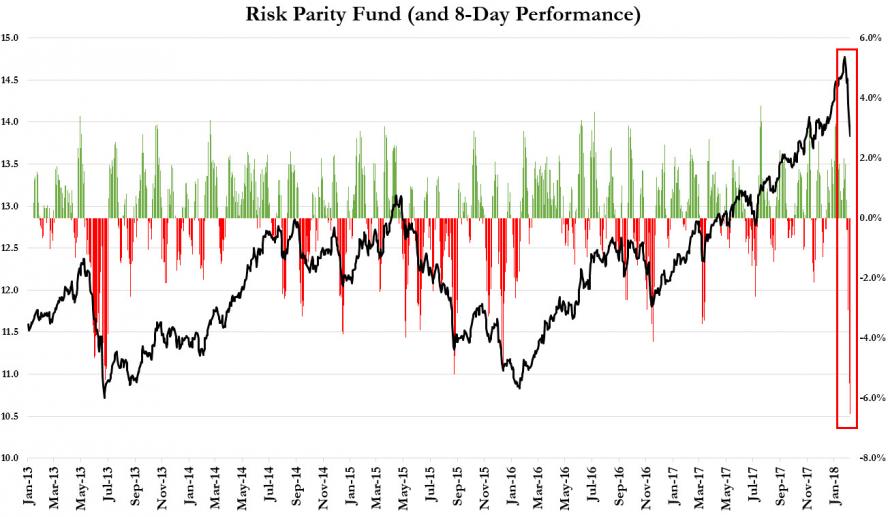

And as Risk-Parity funds see one of their biggest crashes in history…

And Risk-Parity had another ugly day today as aggregate bond and stock returns were negative…

So bonds and stocks were sold…NOTE that as stocks dumped, bonds were bid but that never stabilized stock flows…

In cash markets, the selling started at the open after a gap up…and accelerated into the close!

Leave A Comment