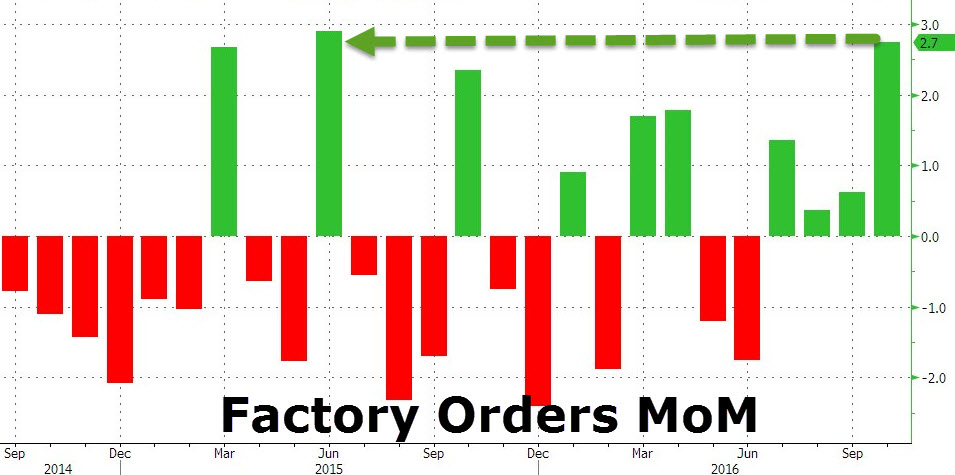

Despite all the uncertainty, all the chaos, all the headlines, and all the media angst, Factory Orders in America surged by the most in 16 months in October ahead of the election.

Factory Orders rose 2.7% MoM (ahead of the 2.6% rise expected) led by am 11.9% spike in Capital Goods orders…

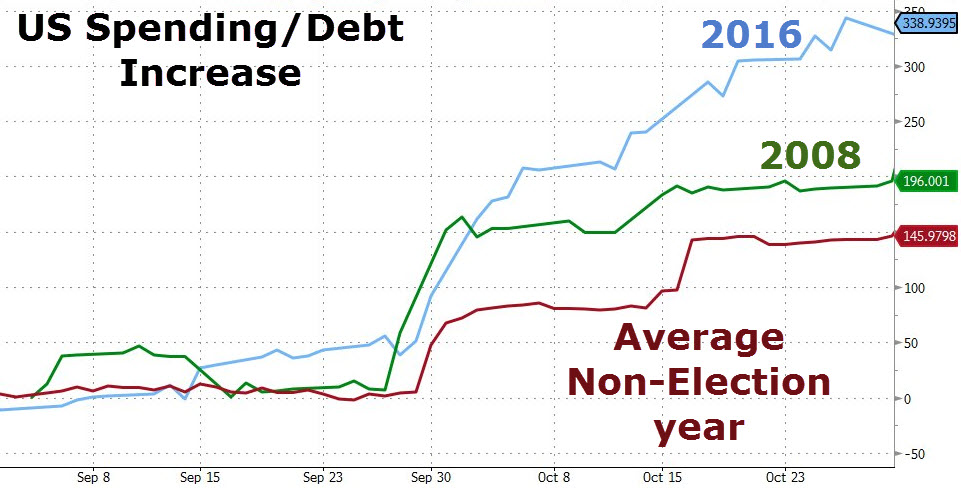

In case this seems odd to anyone, we remind them of what we wrote previously about the election cycle surge in government spending

…

Some pretty good economic reports have energized various parts of the financial markets lately. Consumer spending is up, GDP is exceeding expectations and even factory orders, that perennial downer, popped this morning.

In response, the dollar is soaring and interest rates are at breaking out of their multi-decade down-channel. The economy is clearly recovering, implying a return to normality. Right?

Nah, it’s just the usual election year illusion.

When the presidency is at stake the party in power always pumps up spending in an attempt to put people back to work and create the impression of a well-run country whose leaders deserve more time in the spotlight. After the election, spending returns to trend and the resulting bad news gets buried in “political honeymoon” media coverage.

So don’t hold your breath; don’t extrapolate this… we suspect Trump is being set up for a big fall as the impulse from this surge in government debt/spending fades ahead of his inauguration.

Leave A Comment