June was a good month for Japanese workers. Real wages rose at the fastest pace in eight years, jumping nearly 3% for the first time since 2010. The data, reported by the Japanese Ministry of Health, Labor, and Welfare, was the first piece of positive economic news in some time. As you might expect, the wage figures are being taken as definitive signs the Japanese economy has finally turned the corner.

I’ve lost track of how many corners Japan has never turned. That’s actually the cruel irony of Japanification. Its lost decade, now three, was never about banks. For a good while in the late 1990’s and early 2000’s, there was intense effort to clean up Japan’s zombie banking system because they were all so sure that was what was holding everything back.

The real problem wasn’t bankers, however, it was central bankers. These are the men who time after time (after time) take any small bit of positive news and turn it into the greatest thing ever that cannot possibly mean anything other than full recovery…only to forget about the thing in very short order once it inevitably leads to the same old nowhere.

This is nothing other than corruption. It’s not the what most people think when confronted with the charge, meaning that these aren’t thieves pilfering Japan’s Treasury. They are worse, in that they have plundered Japan’s economy by never giving in and admitting they have no idea what they are doing.

Japanification is, therefore, nothing more than the repeat of the false dawn, the hell of Bill Murray’s Groundhog Day, only capturing an entire nation (or global economy) rather than a single smug idiot from Pittsburgh.

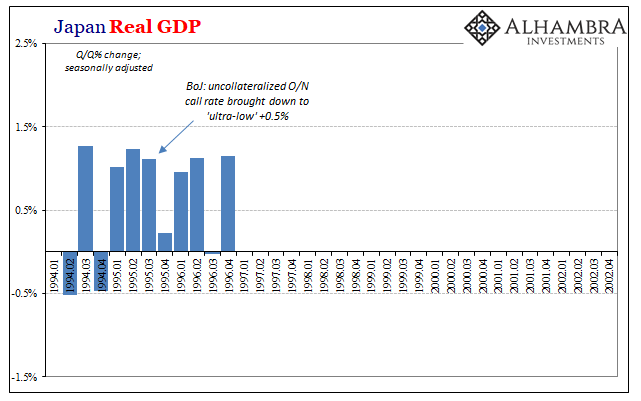

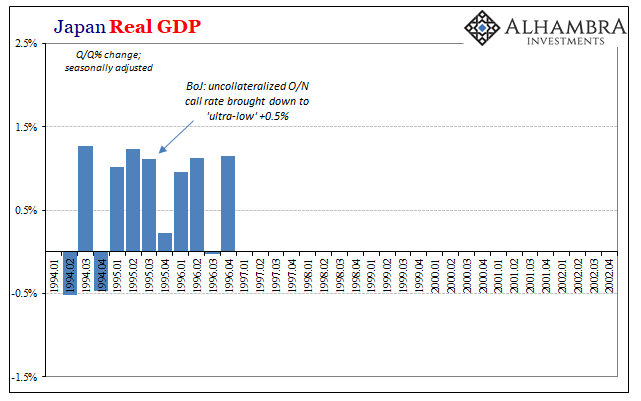

In the middle 1990’s (above), in the initial years after the bubble collapse, the Bank of Japan congratulated itself along with its government sponsors (BoJ was not “independent” in the same way Western-style central bankers were and are until 1998) for successful “stimulus.” GDP growth had resumed, and though at a lower level it was at least somewhat stable.

Leave A Comment