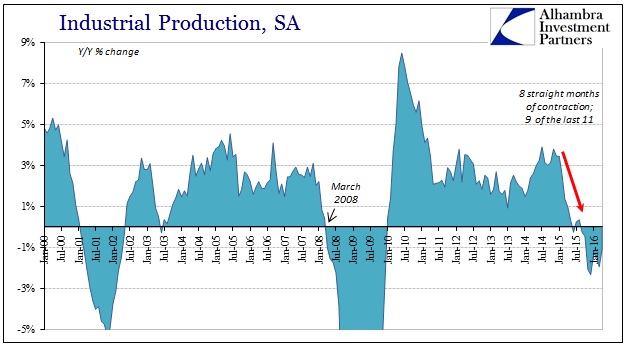

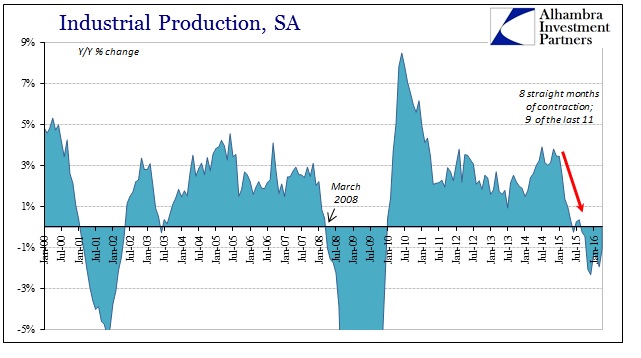

Industrial production contracted for the eighth straight month in April, dropping 1.07% year-over-year. That’s a slight improvement from those prior months but likely only until April’s estimate is revised lower in the coming months. That has been the trend of late in both immediate terms as well as serious long-term revision to benchmarks. As far as the former, it suggests that even though contracting there is a very good chance that US industrial production is doing so at a moderately steeper pace than indicated now.

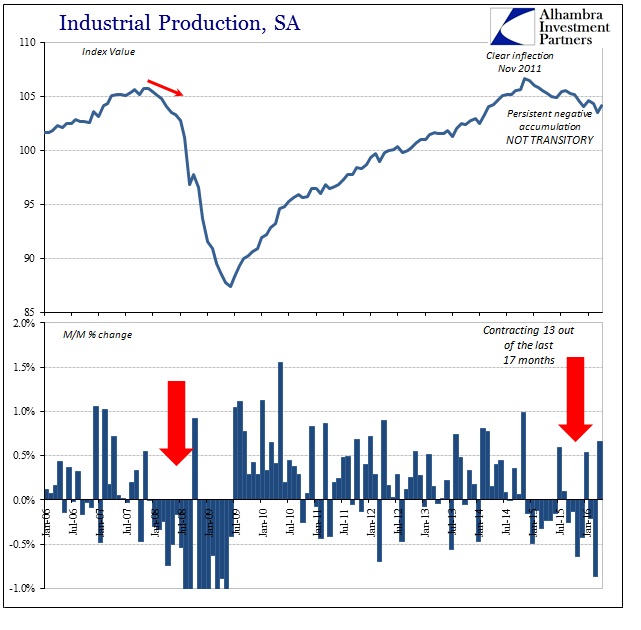

In monthly terms, IP rose in April but again there is no reason to believe that gain will last once the Federal Reserve receives more complete data to incorporate into regular monthly revisions. Even if there was an actual gain in April over March, as you can see below it doesn’t amount to anything more than monthly variation. The trend remains entirely undisturbed, counting now 17 months since the recent peak in November 2014. By comparison, the entirety of the dot-com recession lasted just 17 months in terms of industrial production, yet there is every reason to suspect (more below) the US economy in 2016 is still just getting started in contraction.

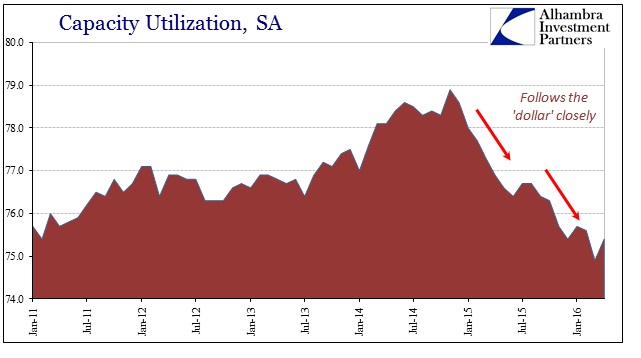

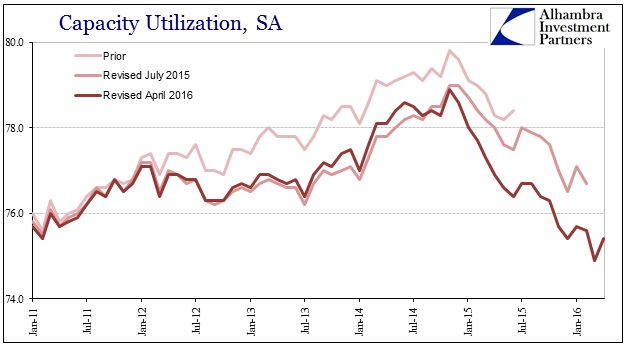

Capacity utilization rose in April to 75.4% from 74.9%, though again there is no cause to believe that will remain the case with further data corrections. The estimated utilization rate in US industrial capacity has been revised significantly both in immediate months as well as at those longer run benchmarks. Since these revisions all run in the same direction, down, there is very little confidence in the accuracy of the figures except that they do agree that in general the “manufacturing recession” continues and continues to get worse.

As with many other economic accounts, we find of late that the Fed was serially overstating the level of economic activity and therefore the whole recovery. As noted with last month’s benchmark revisions, the whole IP series was revised downward largely erasing the acceleration in recovery that economists thought they saw in 2014 and even into 2015. That meant the contraction portion of the slowdown is now calculated to have begun earlier in 2015 but more importantly the data series itself has been forced to belatedly recognize the whole slowdown from its start in 2012.

Leave A Comment