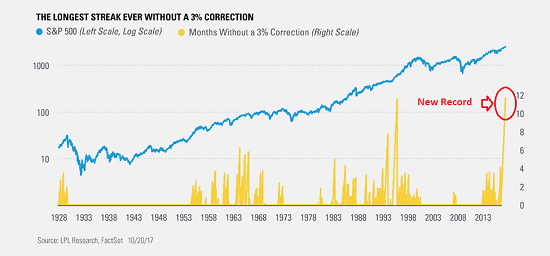

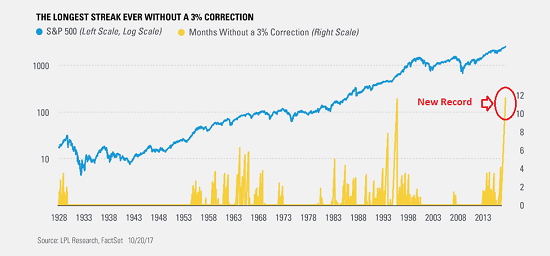

Although the S&P 500 finished the session with the biggest decline in nearly two months, the fact that the venerable index didn’t fall 3% yesterday meant a new record for the longest period of time without a 3% correction in the stock market. According to Ryan Detrick, Monday marked the 242nd trading day without a decline of 3% or more, which eclipsed the old record of 241 days set back in 1995.

And for those keeping score at home, this is not one of those records that is measured over the last 5 or 10 years. No, this data goes back to 1928. Impressive, eh?

In his research post dated 10/22, Mr. Detrick goes on to point out that (a) the S&P has now gone 33 sessions (34 after Monday) without so much as a decline of -0.5%, which is the longest such streak since 1995, (b) the index’s average daily change on an absolute basis in 2017 has been just 0.3%, which would be the smallest for a calendar year since 1965, and (c) the S&P has experienced daily losses of 1% or more only 4 times this year, which is the fewest during a calendar year since 1964.

The point on this fine Tuesday morning is that fear appears to have left the building as everyone on the planet is now a dip-buyer. The bottom line is there doesn’t appear to be any good reasons to sell stocks for more than a day or two. (Oops, I meant an hour or two.)

I started this morning’s meandering market missive by highlighting the new record for the period of time without an itty-bitty correction and some other fun facts to know and tell in the hope it becomes clear that the current market environment just isn’t normal. As such, we probably shouldn’t be surprised if stocks suddenly and without much of a reason, start to decline for more than a few hours.

I know what you’re thinking. Something along the lines of, “Yea, right; like that’s gonna happen!” Am I right?

In behavioral finance, there is a little something called “recency bias.” This theory suggests folks tend to believe that whatever has been happening recently is likely to continue. And while most traders are ready for a pullback, nobody is really expecting one.

Leave A Comment