Two new stocks make September’s Exec Comp Aligned with ROIC Model Portfolio, available to members as of September 14, 2018.

Recap from August’s Picks

Our Exec Comp Aligned with ROIC Model Portfolio (+1.3%) underperformed the S&P 500 (+2.5%) last month. The best performing stock in the portfolio was up 9%. Overall, six out of the 15 Exec Comp Aligned with ROIC Stocks outperformed the S&P in August, and nine had positive returns.

The success of this Model Portfolio highlights the value of our Robo-Analyst technology[1], which scales our forensic accounting expertise (featured in Barron’s) across thousands of stocks.

This Model Portfolio only includes stocks that earn an Attractive or Very Attractive rating and align executive compensation with improving ROIC. We think this combination provides a uniquely well-screened list of long ideas because return on invested capital (ROIC) is the primary driver of shareholder value creation.[2]

New Stock Feature for September: Colgate-Palmolive (CL: $69/share)

Colgate-Palmolive (CL) is the featured stock in September’s Exec Comp Aligned with ROIC Model Portfolio. Colgate was previously featured as a Long Idea in May 2018.

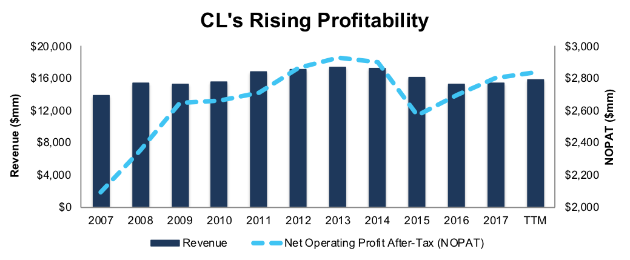

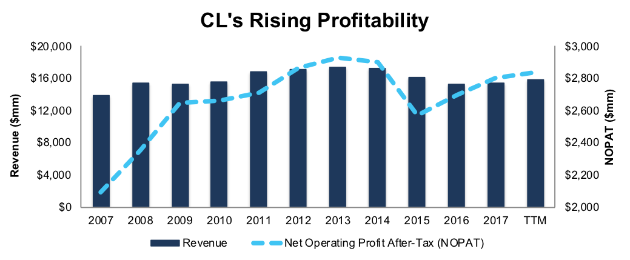

Over the past decade, CL has grown revenue by 1% compounded annually and after-tax operating profit (NOPAT) by 3% compounded annually. CL’s NOPAT margin has improved from 15% in 2007 to 18% over the trailing twelve months (TTM) and it has generated free cash flow (FCF) of $12.7 billion (21% of market cap) over the past five years.

Figure 1: CL’s Revenue & NOPAT Since 2007

Sources: New Constructs, LLC and company filings

Executive Compensation Plan Helps Drive Shareholder Value Creation

Colgate-Palmolive has used ROIC to determine executive salaries, annual bonuses, and long-term incentives since 2014. This focus on improving ROIC aligns the interests of executives and shareholders and helps ensure prudent stewardship of capital. Shareholders can be confident that CL executives will avoid overpriced acquisitions like Newell’s (NWL) deal for Jarden. We believe this superior corporate governance is an underrated competitive advantage.

Leave A Comment