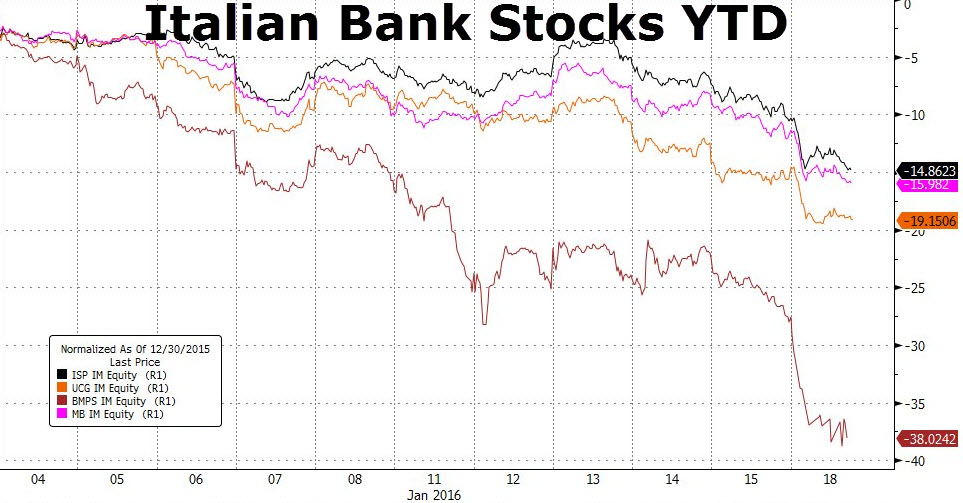

Italian bank stocks are crashing (with BMPS down 40% year-to-date) as Reuters reports that investors are growing increasingly nervous about how the sector will cope with lower interest rates and a 200 billion euro ($218 billion) pile of loans that are unlikely to be repaid. The broad banking sector is down 4% with stocks suspended, and in light of this bloodbath, Italian regulators have decided in their wisdom, to ban short-selling of some bank stocks (which has driven hedgers into the CDS market, spking BMPS credit risk).

Italy’s banking index was down over 4 percent with shares in several lenders, including the country’s biggest retail bank Intesa Sanpaolo and the third biggest lender Banca Monte dei Paschi di Siena,suspended from trading after heavy losses.

Bloodbath for Italian financials in 2016…

But don’t worry:

Reuters reports

Investors are growing increasingly nervous about how the sector will cope with lower interest rates and a 200 billion euro ($218 billion) pile of loans that are unlikely to be repaid.

Those concerns are trumping expectations about a wave of consolidation set to sweep the sector, with cooperative banks under pressure to merge following a government reform to reduce the number of lenders.

JP Morgan said this month Italian banks should be avoided because low rates are expected to put pressure on revenues more than in other countries and credit problems limit a recovery in provisions.

Traders have suggested exiting investments that have been particularly favoured, such as Popolare di Milano and Intesa, as the stocks have reached key supports.

“I think upside on cooperative banks this year is much more limited,” said a London-based equity sales person.

Short interest in Popolare di Milano soared 50 percent to 1.1 percent in the last month, and it rose 10 percent to 3.9 percent for UBI, according to Markit data.

Leave A Comment