“Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee’s 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June…Some participants were concerned that market participants may not have properly assessed the likelihood of an increase in the target range at the June meeting, and they emphasized the importance of communicating clearly over the intermeeting period how the Committee intends to respond to economic and financial developments…

It was noted that communications could help the public understand how the Committee might respond to incoming data and developments over the upcoming intermeeting period. Some members expressed concern that the likelihood implied by market pricing that the Committee would increase the target range for the federal funds rate at the June meeting might be unduly low.” – Minutes of the Federal Reserve Meeting April 26-27, 2016, released May 18, 2016.

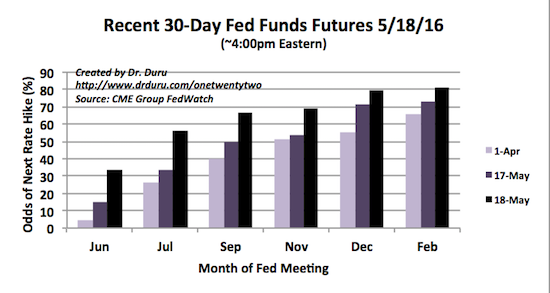

The timing could not have been better. Right on the heels of Fedspeak insisting that financial markets are under-appreciating the odds of a rate hike in June, Minutes of the Federal Reserve Meeting April 26-27, 2016 underlined the Fed’s general commitment to pushing multiple rate hikes through the turnstyle this year. The discussion was convincing enough to rush market expectations for the next rate hike from November of this year to July. The odds for a December hike are high enough to suggest the market even expects two rate hikes this year. The odds for a June rate hike soared from 15% to 34%.

Financial markets are again strong believers in rate hikes for 2016

Source: CME Group FedWatch

As I mentioned in my last post on this topic – Fedspeak insisting that financial markets are under-appreciating the odds of a rate hike in June – the market’s slow appreciation of the Fed’s seriousness presented an opportunity to get long the U.S. dollar, short emerging markets, and short commodities. I missed one other opportunity: get long financials. I honestly forgot about the Fed minutes as the next catalyst. Still, I think the market is only going to adjust reluctantly to the changing reality surrounding the prospects for rate hikes. (Since I follow what the Fed Fund futures do, I was also reluctant to believe!) The futures can move a lot faster than portfolio managers with positions spread across some poor plays for a rate-hiking cycle.

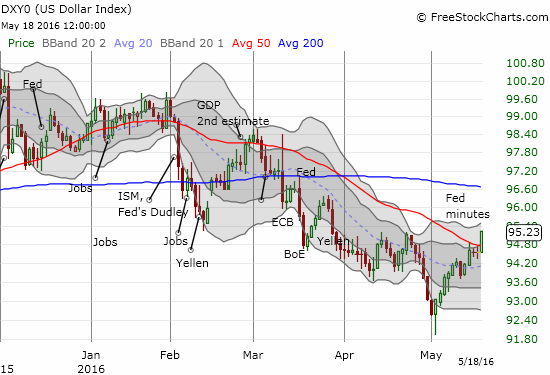

The U.S. dollar index (DXY0) convincingly broke through resistance at its 50-day moving average. This confirms the dollar has indeed bottomed for now.

The U.S. dollar index breaks through critical resistance.

Leave A Comment