from the St Louis Fed

— this post authored by Fernando Martin, Research Officer and Economist

The Federal Reserve implemented a number of policies to combat the effects of the 2007-08 financial crisis and the recession that followed. Three of these are notable for their persistent impact on short-term liquidity markets:

The Federal Funds Rate

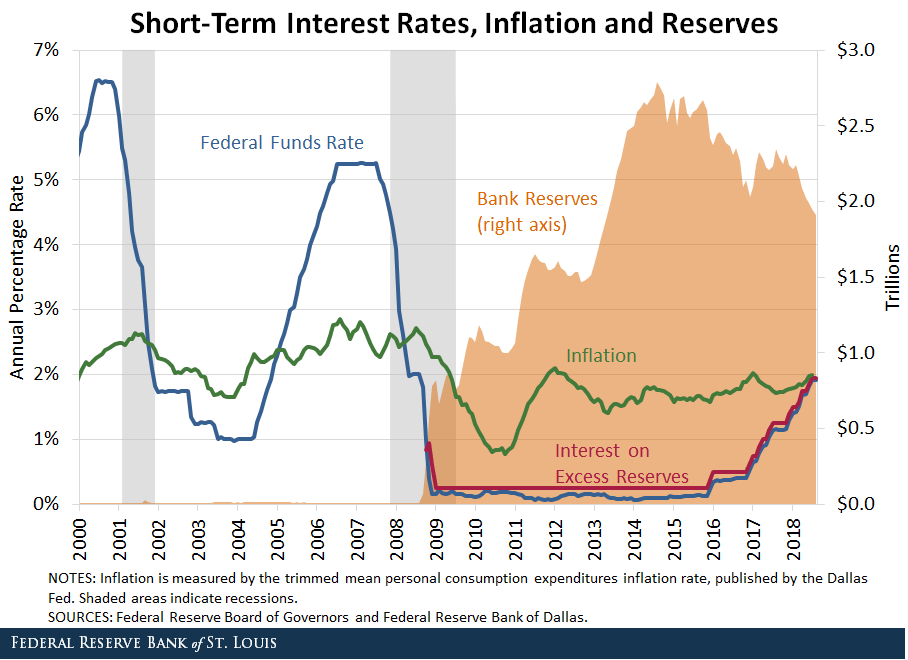

First, the target for the federal funds rate (FFR), which largely determines other market short-term rates, was set near zero from December 2008 until “liftoff” in December 2015. As of September, the target range for the FFR was set at 2 to 2.25 percent annual, which is still considered low by historical standards. The figure below shows the effective FFR, which falls within the target range set by the Fed.

Interest on Excess Reserves

Second, the Fed began paying interest on banks’ reserve balances in October 2008. (The Federal Reserve Act had to be amended to allow this.) The interest on excess reserves (IOER) was 1.98 percent annual in September.

In theory, the IOER should work as a floor on overnight interest rates, since no bank would lend reserves to other institutions at a rate lower than what it can get from the Fed.1

IOER and the FFR

As the figure shows, the IOER has systematically been above the effective FFR. This means that some institutions with excess liquidity that participate in the federal funds market were not earning at least the IOER.

One reason is that not all institutions participating in the federal funds market have a deposit account at the Fed. Chiefly among these institutions are government-sponsored enterprises (GSEs).

To provide an effective floor, the Fed opened an overnight reverse-repo facility, which allowed a broad set of financial institutions to earn a minimum rate by lending funds to the Fed.2

Other Short-Term Interest Rates

Leave A Comment