A big rally last Tuesday was met with selling pressure the remainder of the week and all but wiped out Tuesday’s gains. For the week, the Dow Jones Industrial Average (DJIA) index gained 0.4% and the S&P 500 rose fractionally, successfully snapping a three-week retreat while the Nasdaq (NDX) shed 0.6% to extend losses into a third week. Tech and small-cap stocks have been hit the hardest during this latest bout of market selling pressure that began with the commencement of the 4th Quarter. October has indeed been a scary month for equity investors thus far and this coming week may not prove to relieve investor anxiety.

Volatility Remains Elevated

Along with equities coming under pressure recently, volatility has been on the rise. The VIX finished just below 20 last week, down from 21+ in the previous week. A VIX around the 20 level is not market friendly and combined with the rather sizable SPX weekly expected move, investors and traders should expect what we saw from the market last week, somewhat mirrored in the coming week. To validate this forecast, we also turn to the Volatility of Volatility (VVIX) index which is presently well above 100.

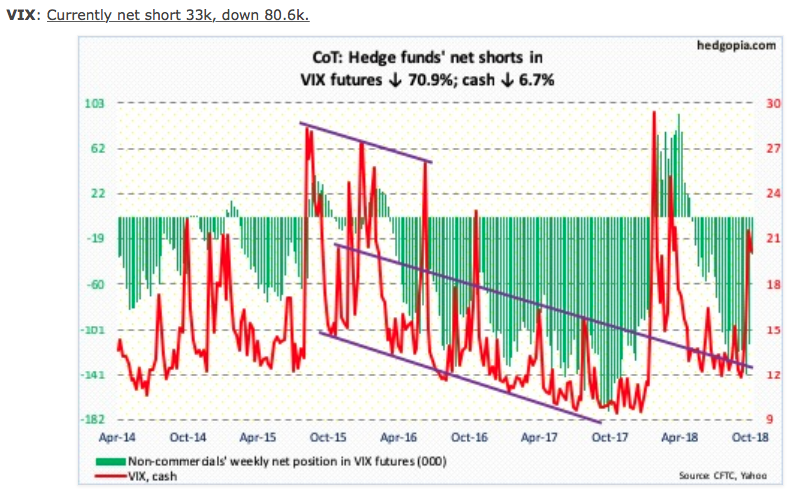

A reading above 100 tells us that hedge funds are buying OTM calls, pushing up VVIX as they hedge their greater equity exposure. For further validation of what may come in the week ahead let’s take a look at how hedge funds are positioned in VIX Futures.

The biggest takeaway here is the net short VIX Futures position. The net short position has been reduced by some 80K contracts, suggesting hedge fund participants are expecting future bouts of higher volatility in the market. Collectively, the aforementioned variables align for rising volatility near-term, but a guarantee they are not.

As I mentioned before, this coming trading week’s expected move is rather large but lesser than that from the $71 expected move in the week that was.

Although we came nowhere near achieving the expected move this past week, we fell within the expected move once again and after breaching the expected move in the week before and by a wide margin. This coming week’s expected move is $66, signaling heightened levels of volatility and fear in the market. Simply put, although earnings have been coming in better than expected, as they have in each of the prior 2 reporting periods for 2018, the selling pressure has persisted. We saw much of the same market activity during Q1 and at the onset of the Q2 reporting period. Shortly thereafter investors did bid up equities in each of the reporting periods, reflecting economic growth and corporate earnings growth. Has something changed, all of a sudden, or are we simply seeing the same pattern of market activity in the current earnings reporting season?

Bottoming Process

It’s difficult to forecast how close the market is from bottoming. There are a great many analysts and market watchers suggesting there is more room to the downside and a retest of the recent lows must be achieved before a Q4 rally can commence.

One thing to keep in mind as we continue to look for a near-term market bottom is the following: A market bottom is not just a bottom; it’s a bottoming process, as detailed further by Tony Dwyer of Canaccord Genuity.

Leave A Comment