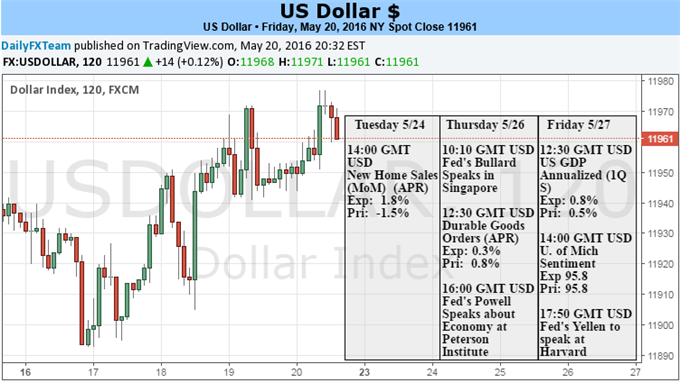

Fundamental Forecast for Dollar: Neutral

The Dollar is finding some serious reprieve from a painful three months of selling pressure. Over the past three weeks, the currency has advanced between 0.8 and 5.0 percent (versus the British Pound and Australian Dollar respectively). Rather than finding its motivation in external sources like thematic risk trends or strong crosswinds from motivated counterparts, the advance is proving innate. The FOMC minutes this past week finally cracked the speculative rank’s skepticism over the potential for 2016 rate hikes. However, that revival of credibility also opens the door to greater sensitivity to another run of charged Fed-speak in the week ahead. Will the leverage in volatility be worth the market’s acquiescence?

While a 28 percent probability of a FOMC rate hike on June 15 – the next scheduled FOMC minute complete with forecasts and Chairwoman press conference – may not seem profound, compared to the rigid incredulity of follow-up 2016 rate hikes in the wake of the December ‘liftoff’ is remarkable. Only a week ago (May 13), the market was pricing a scant 4 percent probability of a move at the next meeting. A chance of a full 25 basis point hike through the end of the year was only 53 percent on the same day. That had significantly undermined one of the Dollar’s most profound fundamental drivers over the past four three-plus years.

It is worth looking back at the minutes this past week to see why they had such a profound impact. Qualitatively, the view the group took was not materially more optimistic or aggressive than previous meetings. Sure, the absence of ‘global’ pressures was welcome, but the emphasis of ‘two-to-three hikes in 2016’ – as SF Fed President John Williams stated – has been the standard language among the group. Recognizing the persistence of the market’s discount to their own view, the Fed realized the need to deliver a greater sense of certitude that a hike could be on the agenda or risk a shock of volatility to the system when tightening did come around – which would invariably make their job far more difficult and likely force an immediate course reversal. The heavy inference of a ‘June’ move and balance of confidence in reduced negative risks provided the crucial push.

Leave A Comment