Fed Has A Difficult Job

In terms of government policy, the economy has two primary types of stimulus, fiscal and monetary. The Fed controls monetary policy. Congress is the primary driver of fiscal policy.

In recent years, Congress has left all the heavy lifting to the Fed. Having stated the Fed is in a difficult position, their focus in recent years appears to have shifted almost solely to keeping asset prices propped up, a concept that has not gone unnoticed by the financial markets.

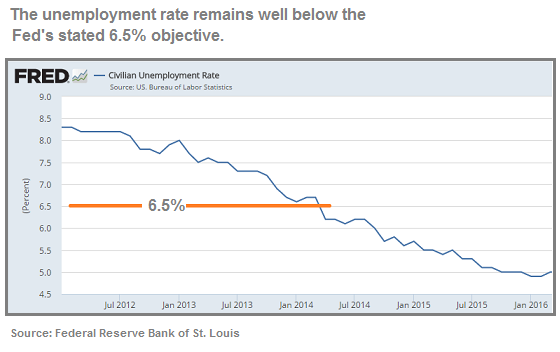

2012 Plan Was To Raise Rates When Unemployment Hit 6.5%

In December 2012, the Federal Reserve provided a 6.5% unemployment target with respect to allowing rates to remain near zero. From USA Today:

The Federal Reserve on Wednesday agreed to keep a key short-term rate near zero until the 7.7% unemployment rate is 6.5% or lower.

Goalpost Taken Down In 2014

The chart below shows the unemployment rate between 2012 and 2016. As you can see, unemployment has been below the Fed’s 6.5% target for some time.

Since it would be a constant source of “why are you still waiting to raise rates” questions, the Fed decided in April 2014 to remove the unemployment goalpost. From CNBC:

The members of the Federal Open Market Committee agreed unanimously in March that a 6.5 percent unemployment target for raising interest rates was “outdated” and should be removed, according to meeting minutes.

The Fed Originally Choose An “Outdated” Target

Rather than face the difficult decision to begin raising interest rates, the Fed kicked the can down the road after calling their own stated unemployment target “outdated”, which begs the question if the target is outdated, then why did the Fed use it in the first place? Did the 6.5% target somehow become outdated between 2012 and 2014?

We Can Afford To Be Patient

In a move that surprised the markets, the Fed stated in March 2015 that it still needed to see more. From the Chicago Tribune:

The Federal Reserve signaled Wednesday that it needs to see further improvement in the job market and higher inflation before it raises interest rates from record lows.

Leave A Comment