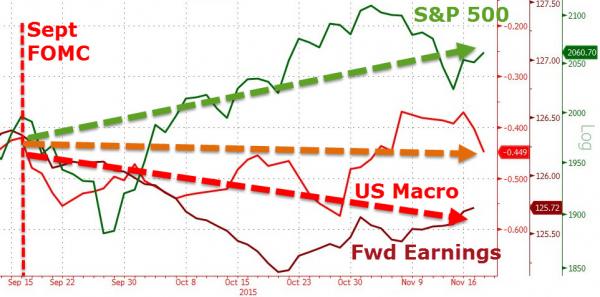

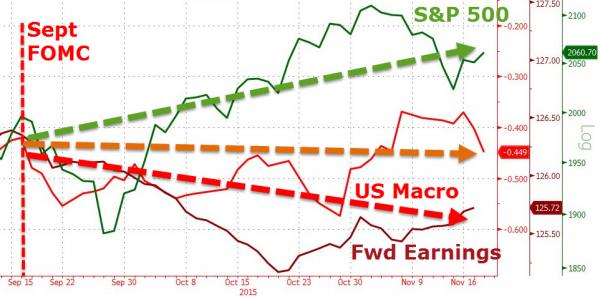

As if we needed yet more confirmation that The Fed is Dow-Data-Dependent (not economic data dependent), Reuters reports that The Fed’s Jeff Lacker thinks rate should rise now that “markets have calmed”…

Global financial markets have settled since the August turmoil that caused the U.S. Federal Reserve to delay raising rates, so that it will soon be appropriate to make the policy change, Atlanta Fed President Dennis Lockhart said on Wednesday.

“I am now reasonably satisfied the situation has settled down… So I am comfortable with moving off zero soon, conditioned on no marked deterioration in economic conditions,”Lockhart told a conference of bankers, traders and regulators.

“I believe it will soon be appropriate to begin a new policy phase,” he said, adding he will monitor economic data between now and a policy meeting on Dec. 15-16.

So what changed?

Which begs the question – what happens if VIX rises and stocks fall between now and December?

Charts: Bloomberg

Leave A Comment